In the internet age, effectively growing awareness of your online presence and converting leads into sales is crucial to your business’ success. It is not enough to simply be online and offer products – you want to be selling them. This is where ecommerce growth hacks come in.

Growth hacks are cost-effective and low-resource marketing tactics to rapidly grow a business, using rapid experimentation and regular testing to improve the customer experience.

Growth hacking used to be the exclusive domain of early-stage startups. Startups are often in the challenging position of having to achieve rapid growth on a tight timeline and an even tighter budget, leaving them unable to resort to traditional marketing. However, nowadays even the biggest companies have started exploring the utility and relevance of growth hacks for their business models.

To truly maximize your online sales and success, you should consider implementing ecommerce growth hacks into your business strategy.

When integrating growth hacks into your organization, make sure to also consider how well your online presence functions more generally – is it working securely and as intended? You’ll want your IT team to be able to create efficient bug reports in software testing for your platforms to run as smoothly as possible.

There are a plethora of growth hacks out there, but it’s hard to know where to start – or which to prioritize. This article will help you to get a start in your own organization with nine straightforward and actionable growth hacks that will boost your sales.

1. FOMO & the power of urgency

The customer’s journey is time-sensitive. Customers only have so much time to spend looking for products, and unless it’s a truly urgent purchase they will browse and compare at their own leisure.

For this potential customer to choose your product or service and choose it as soon as possible, you need to present them with an enticing offer, that they know they need to jump on quickly. This is where FOMO, or the ‘fear of missing out’, comes in.

FOMO, is a social phenomenon that, as the name implies, can prompt quick decision making for fear of missing out. Use it sparingly – too often and your buyer will learn they can simply wait for your next limited time offer – and you can create a sense of urgency in your prospective customer.

Image source

Utilize ‘limited time offer’ pop-up ads on your website, and send out email campaigns to your subscribers emphasizing the scarcity of supply and limited time they have left to pick up this deal.

2. Popularity & peer pressure

Closely related to FOMO, you should also utilize the psychology of popularity. Your buyers are human, and humans are social creatures – we care about and take note of what our peers do. If a product is selling out quickly, it appears popular and thus attractive: ‘lots of people have/want this, maybe I need it too!’

The value of a product is increased in the eyes of the potential customer because they can see it is valued by their peers. This influences the potential buyer’s desire to make a purchase while they have the chance.

You need to give your potential buyer to see a product’s popularity linked to a sense of scarcity. Again, use these methods sparingly, but you might consider implementing things like a real-time stock counter for items you want to emphasize as limited. You might also include product reviews to emphasize quality, and might even highlight how many people purchased that particular item within the last hour.

Once those customers are inevitably enticed to make the purchase, you’ll also want to have a robust online payment gateway in place.

3. Reward Programmes – giving them a reason to come back

Rewarding a customer’s loyalty and continued business is a simple yet extremely effective growth hack. You want to keep your customer invested in your brand. After all, if they see exclusive rewards for repeat business, why would they go elsewhere where they’d have to build a new relationship?

If a customer trusts in your brand and feels that they are valued, they will come back for more.

If a customer visits a set number of pages, or a particular page or product, perhaps offer them a discount. Better yet, incorporate an email sign-up where they can join your subscription list, offering them something like a % discount for their first or subsequent orders.

Here’s an example from popular clothing brand AllSaints:

Image Source

You don’t have to offer discounts constantly for these reward programmes to do the trick. Even the occasional offer will incentivise a customer to return.

Use this sparingly. After all, if the discounts are constant, customers will never even have the opportunity to pay full price.

4. Mobile apps – always with the consumer on the go

Mobile apps are great, aren’t they? Easily within reach, accessible to everyone with a smartphone – 85% of US adults as of 2021. And that number is only increasing.

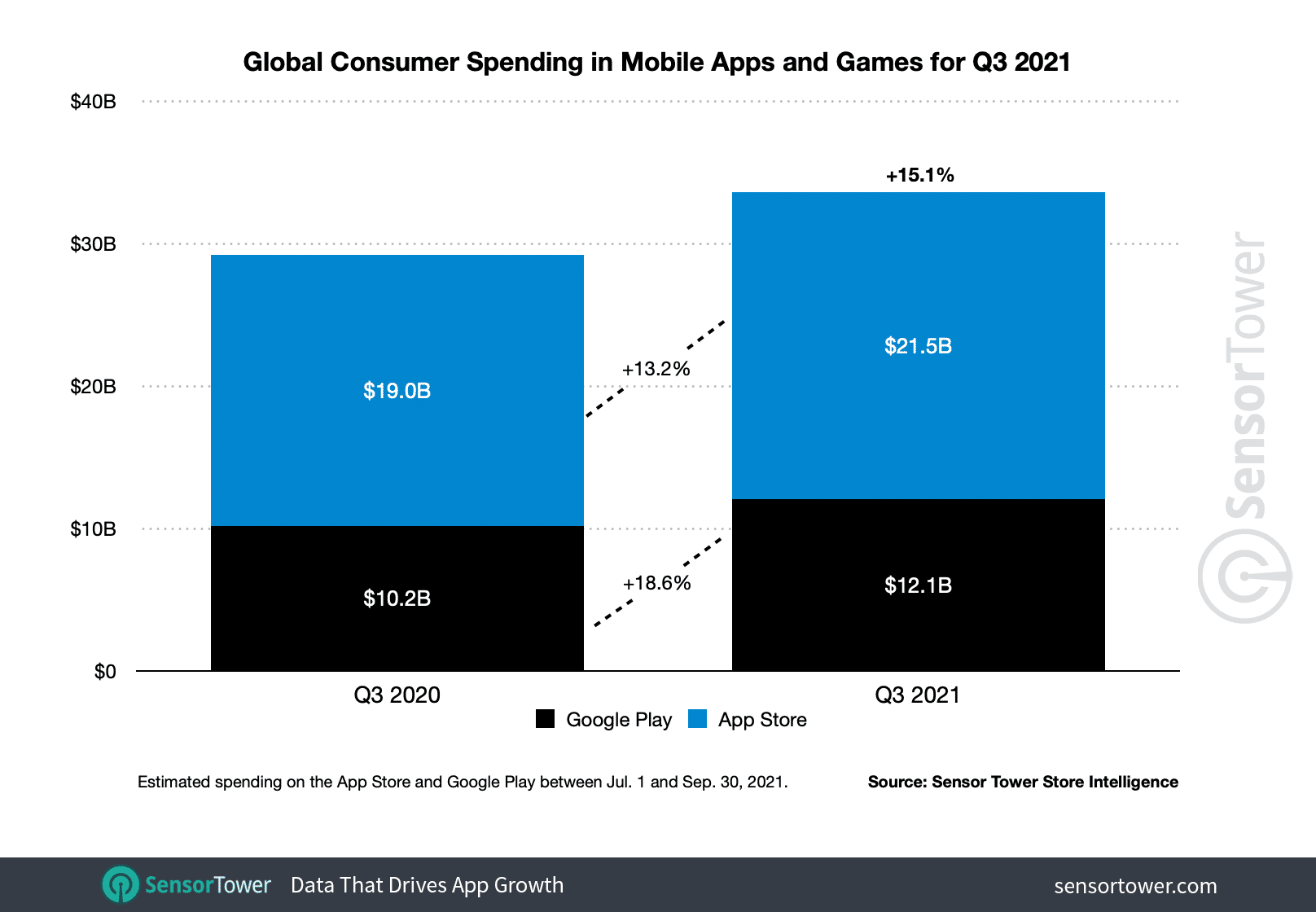

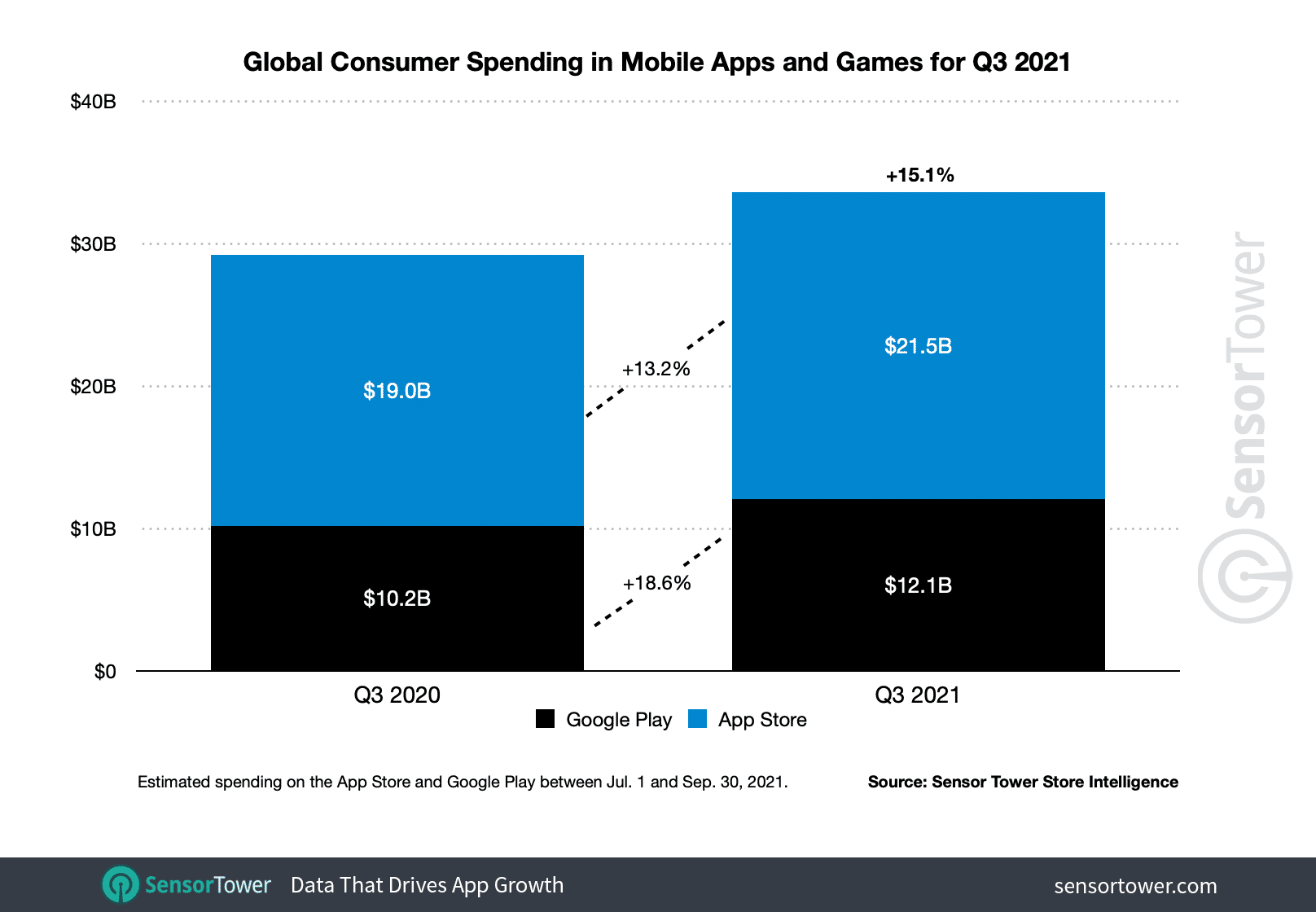

People love their phones, they love the apps on them, and they love to spend money on those apps. Global app revenue has climbed 15% year-over-year in Q3 2021 to nearly $34 billion. That’s an incredible increase! There is global opportunity here, that you need to have the means to engage with.

Image Source

Creating a mobile app that is specifically optimized for mobile users will ensure the best possible experience for your potential customers who are always on the go. There are numerous advantages of ecommerce mobile apps that you need to be utilizing right now.

With that in mind, you don’t want pop-ups too small to read or click – make sure that the UI (user interface) is as easy to read and understand as possible. Customer experience is essential to gain the benefits of an app. In order to incentivise app use, consider offering exclusive discounts or products only available to the app user.

If you’re struggling or want to know more about the software, there are always QA conferences ongoing globally.

5. Cart abandonment – how to handle

This is a big one. Cart abandonment is a big issue felt especially on mobile devices, where up to 85% of purchases on a cell phone are abandoned at cart.

Potential customers can get distracted or put off, even at as late a stage in the customer’s journey as adding a specific product to their cart. You want to avoid and minimize this distraction and incentivise their making a purchase as much as possible.

Shipping fees are a major reason for a buyer to be put off at the last second. Consider offering free shipping to entice those customers to finalize their purchase. Remember also to scale discounts or incentives accordingly.

Free shipping is great for buyers who don’t meet the minimum threshold, but is useless to those who do. For these customers, consider offering upgraded shipping that will deliver what they considered purchasing sooner.

You should be using critical features like network monitoring to make sure that everything is working as intended; a smooth service will also reduce cart abandonment.

6. Live chat – hey, I’m talkin’ here

Nobody wants to spend ages looking for answers to their questions. If info about your product or service isn’t easily accessible, consider adding a live chat feature. This gives the potential customer the chance to communicate in real-time, getting answers for their specific questions and issues in a responsive and tailored way.

Live chat is a conversation, and feels much more engaging and high-effort than something like a simple FAQ section. This makes the customer feel valued, which in turn increases the customer’s time spent on your online site and positively impacts customer satisfaction, loyalty and conversion rates. Software QA companies are a great way to monitor the success and impact of this feature.

7. Minimalism & optimisation – less is more

Simplification and streamlining are enormously beneficial growth hacks to boost sales.

What do we mean by this? Consider the UI of a theoretical online site. There might be buttons everywhere, redirections and just too much information in the customer’s face. It is likely all these redirects contain important info and features for the potential customer, but they also present something you want to avoid at all costs – distraction.

Constant suggestion, too many options can overwhelm, so keep it simple. A single ‘proceed to checkout’ button will suffice, instead of overloading the customer with options like ‘empty basket’ or redirecting them to another page.

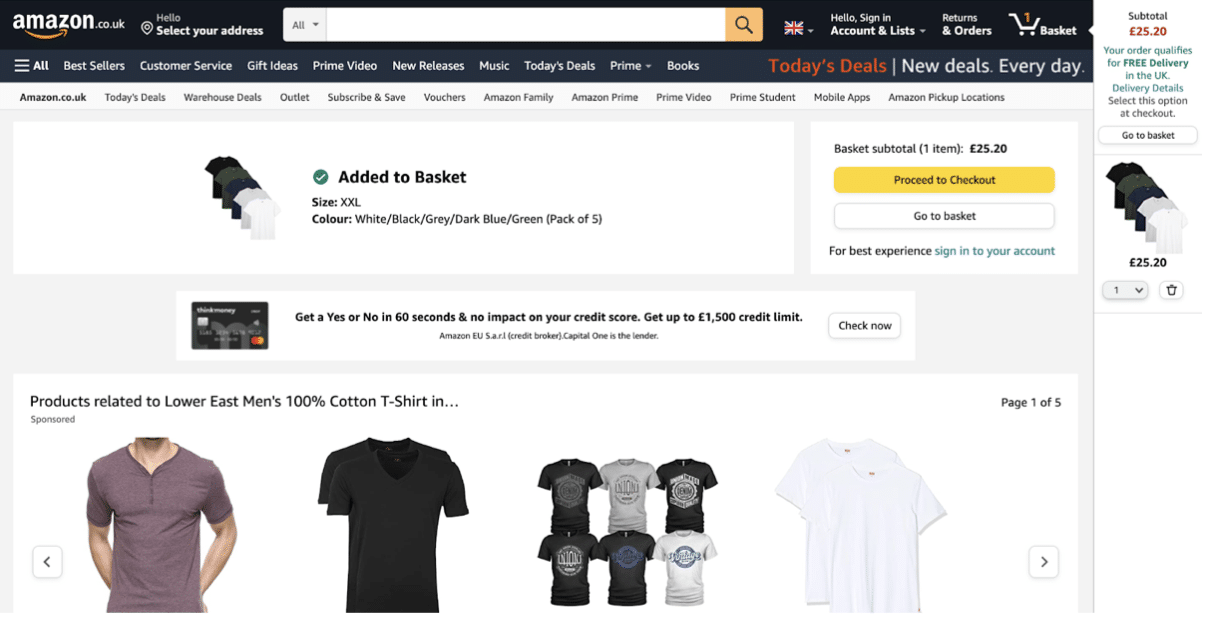

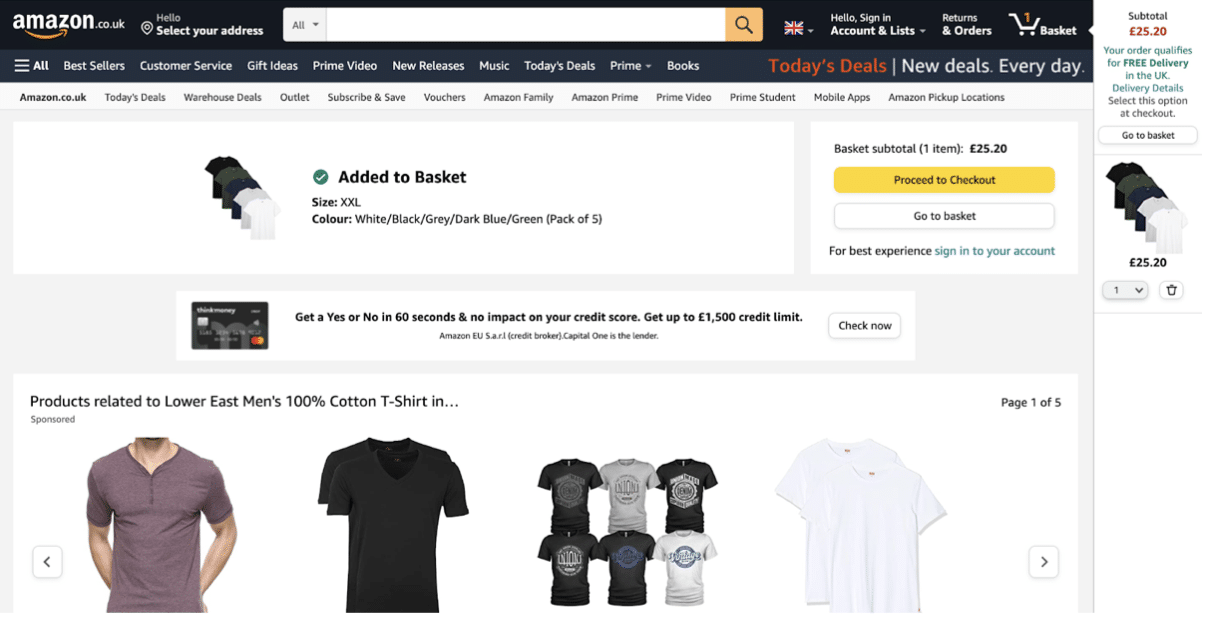

Here’s how the ecommerce juggernaut Amazon approaches things:

I typed in ‘T-shirts’, and added the first item from my search to my basket. I was brought to this page, with simple next steps and related products. I have only the necessary info, and don’t feel overwhelmed with ads or overly pressured – less is more.

Be careful too not to inundate with options to sign up to email lists – you don’t want to appear desperate or overly promotional. If you like what you see from Amazon, know also that you can use fulfillment by Amazon (FBA) to utilize their efficient system to get your orders filled fast.

8. Competitions and giveaways – give and you shall receive

Competitions are a win-win. If you do a giveaway, someone will win – that’s great for them. But in the process, you could win many, many new leads – that’s great for you.

This is a pretty straightforward hack. You garner interest, publicity, and incentivize potential customers by making them aware that you have products and/or services that they could win, completely free of charge.

Giveaways can be used to sign people up to your email campaigns or to tag their friends in social media posts thus generating more publicity. Giveaways get them to follow your page, exposing them to more of what you have to offer to them, and lead to sales and positive reviews.

Expanding your reach is essential to boosting sales, and competitions are a great way to do so. If you haven’t tried one, now’s the time to give giveaways a shot.

9. Consistency is key

Consistency builds trust in a brand.

Let’s take the example of Nike’s brand. When I think of Nike, I know what the brand offers in terms of quality, price, you name it – Nike is a known quantity. This is because they are consistent. Across platforms, in language, in UI, in their iconic ‘tick’ branding – I know what I’m going to get.

This builds familiarity and trust – and subsequently, sales – that a brand that’s all over the place or confusing cannot hope to emulate. Nike offers a consistent service, and its customers have invested an understanding of it. You should also consider things like the social values your brand presents.

Image source

Let’s illustrate this further. Imagine it was my birthday. I’m a loyal customer and Nike offered me 10% off my next purchase – wonderful! What a great birthday treat. But then next week when it’s my friend’s birthday, they get offered 15% off. As a loyal customer, how do you think I’ll feel about Nike then? They offered me a birthday discount – which they didn’t have to – but it wasn’t the same for everyone.

Inconsistency negatively affects customer perception and sales. Make sure that marketing tactics are clearly communicated amongst your organization. It is vital that you avoid appearing inconsistent at all costs. For comprehensive communication to maintain inconsistency across larger teams, consider implementing free WebEx alternatives. Communication is key in ensuring your growth hacking efforts are well-integrated across your organization.

With that in mind, you’re ready to begin your journey into growth hacking. After a little initial planning and deciding what tactics are best suited to your organization, you’ll begin seeing results in your growth and marketing reach in no time.

Kate Priestman – Head Of Marketing, Global App Testing

Kate Priestman – Head Of Marketing, Global App Testing

Kate Priestman is the Head of Marketing at Global App Testing, a trusted and leading end-to-end functional testing solution and

automation test planning for QA challenges. Kate has over 8 years of experience in the field of marketing, helping brands achieve exceptional growth. She has extensive knowledge on brand development, lead and demand generation, and marketing strategy — driving business impact at its best. Kate Priestman also published articles for domains such as

CEO Blog Nation and

Stackify. You can connect with her on

LinkedIn.

Kate Priestman – Head Of Marketing, Global App Testing

Kate Priestman – Head Of Marketing, Global App Testing