B2B Vs. B2C: the Differences Every Marketer Should Know

If you have any experience in the business world, you’ll have come across the terms B2B and B2C. B2B stands for Business to Business and describes the business strategy of companies who sell their product or services to other businesses.

B2C stands for Business to Customer and is the business strategy of companies who sell their product to the mass consumer market. The contrasts between B2B and B2C are essentially the difference between wholesale and retail.

B2B marketing tends to focus on more logical, process-driven purchasing decisions due to the target market being businesses. B2C marketing, however, tends to focus more on emotionally driven purchasing decisions due to the target market being end consumers. They may overlap sometimes but the marketing strategy differences are still significant.

Understanding these differences is key to building a high-performance marketing strategy. Let’s look at some key differences between B2B and B2C marketing.

1. Customer Relations

B2B

The target audience in the B2B model is businesses. You’re a business marketing your product or service to other businesses. Your marketing focus is going to be on creating and building more personal relationships that will lead to long-term business.

Personal relationships are important as potential clients get to know your practices, ethics, and morals. These things can separate you from your competition and let your target audience know that you are a good, reliable supplier. These are long-term qualities that business people look for.

Building these business relationships and generating leads creates repeat and referral business. So developing relationships with target audiences is crucial for B2B businesses. One way to do this is to allow customers to call you at any time using a toll-free number.

B2C

The target audience in the B2C model is retail consumers. You’re a business marketing your product or service to consumers. Your marketing focus here is going to be on leading consumers to your ecommerce store and driving sales.

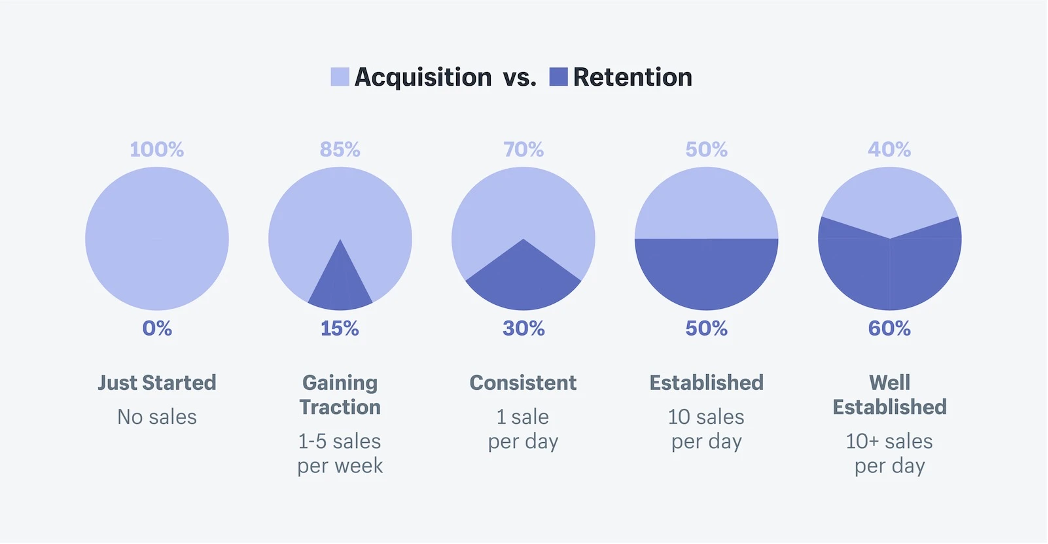

Because you’re only generating one or two small sales at a time with no guarantee of long-term business, your marketing focus can’t be on building personal relationships. Instead, B2C businesses need to focus on sales efficiency and creating extremely transactional relationships.

The marketing strategy for B2C focuses on selling the product, with the majority of time spent on delivering high-quality products as quickly as possible. One way to speed up the customer experience is to use AI customer service.

2. Branding

B2B

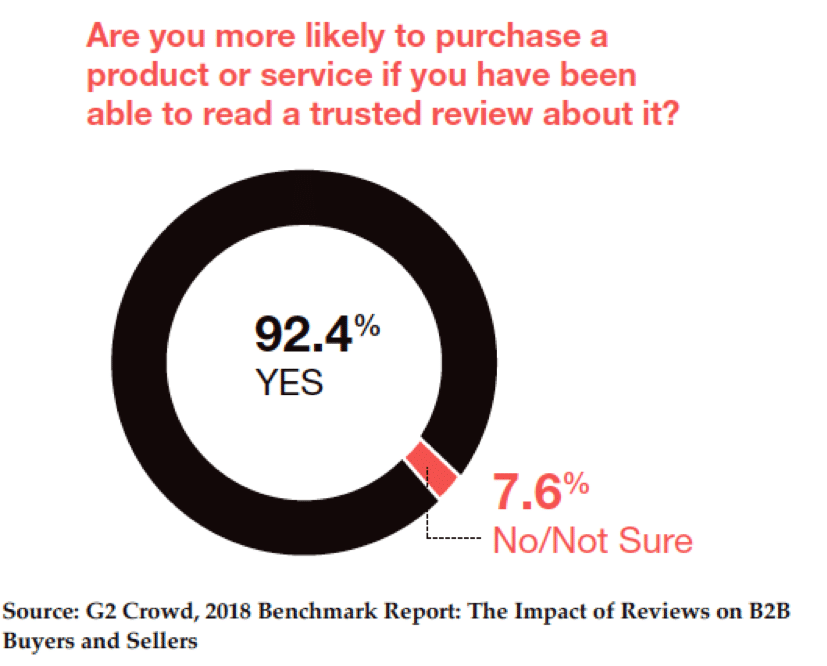

As mentioned above, in B2B marketing, the focus is on relationship building. This applies to branding as well. Honoring relationships through consistent presentation and delivery of products or services will build your reputation or brand in the industry.

Your target audience is businesses whose decision-making is business-oriented. To build your brand you’ll need to market your position in the industry and let your personality shine. This will build brand recognition and generate leads. Don’t forget to adjust your brand towards your target audience and be aware of their personalities.

B2C

When marketing to a B2C audience, branding is essential. Having a strong brand allows you to deliver a message, build brand loyalty, create credibility, emotionally connect with customers, and motivate purchases.

Branding is the number one priority of B2C marketing due to the fact that the customer and business don’t interact a lot. To make up for this you have to create a lasting, positive opinion and provide a quality experience for the customer, ensuring repeat sales.

Building a brand with a good reputation can be achieved by delivering clear, credible messages, and creating motivational copy that resonates with consumers.

3. Decision-Making Process

B2B

The decision-making process in the B2B model involves more open communication between businesses so that both parties can decide if it would be a good partnership. Therefore appeals to emotional and rational decisions can be made.

In B2B, the decision-making process sees customers evaluating their needs which can have rational and emotional motivators. Rational motivations are driven by financial mindsets; is this a good investment? Emotional motivations are driven by emotional connections; Will we lose money and have to fire some staff?

Understanding your audience can help you comprehend the decision-making process that may apply to you. This allows you to get ahead of competitors by creating an emotional connection through clear, specific messaging.

B2C

With B2C, the focus is on the sales funnel. Marketers should use their knowledge of the conversion funnel in the decision-making process, maximizing ROI. At the top of this funnel are advertisements that give customers the need for a product.

Now, the customer will know what product they want to purchase. However, unlike B2B, customers are more open when looking for a specific product to buy.

That is why it’s essential to simplify the decision-making process for consumers while continuing to appeal to them. There is still a high chance that consumers are looking at your competitors as well. Using an influencer marketing campaign is a great strategy, especially when paired with discounts via a referral code.

4. Audience Targeting

B2B

B2B businesses operate in a niche market, and so it’s very important to know your target demographic. An example of a niche may be cheap electronic parts made specifically for the Indian market. To effectively attract customers, you must compile and analyze accurate data (both qualitative and quantitative).

B2C

Since the target audience is so broad (retail customers), B2C businesses must work in larger-scale markets. For marketers, the marketing funnel is crucial for attracting customers.

Start at the top of the funnel and cast a wide net. Use emotional and product-driven advertisements. From there you can create a warm lead list and remarket to those target audiences who showed interest.

5. Ad Copy

B2B

In B2B it is important for you to speak your target audience’s language. This is because businesses want to partner with experts who understand their industry. Understanding the terminology, processes, and even the decisions made by customer businesses can greatly increase the chances of a purchase.

B2C

In B2C, customers only care about the product or service they receive. So instead of using industry jargon, you can use more straightforward language to speak to customers in a relatable voice. Aim to evoke emotion in your audience.

B2C customers want to enjoy a purchase, whereas B2B customers are making a rational, logical financial purchase.

Conclusion

As a marketer, it is crucial that you understand the key differences between B2B and B2C marketing.

Knowing these key differences will drastically change your marketing strategy and allow you to create highly effective marketing practices applicable to both B2B and B2C businesses.

-Grace Lau is the Director of Growth Content at Dialpad, an AI-powered cloud PBX phone system for better and easier team collaboration. She has over 10 years of experience in content writing and strategy. Currently, she is responsible for leading branded and editorial content strategies, partnering with SEO and Ops teams to build and nurture content. Here is her LinkedIn