How are mobile payment gateways transforming the online shopping experience?

Mobiles are an inseparable part of our lives. Most of us prefer to do everything on our phones, including shopping. It comes as no surprise that 73% of people used their mobiles to make online purchases in 2021. And the number is only going to continue rising because of the convenience customers get from shopping using their phones.

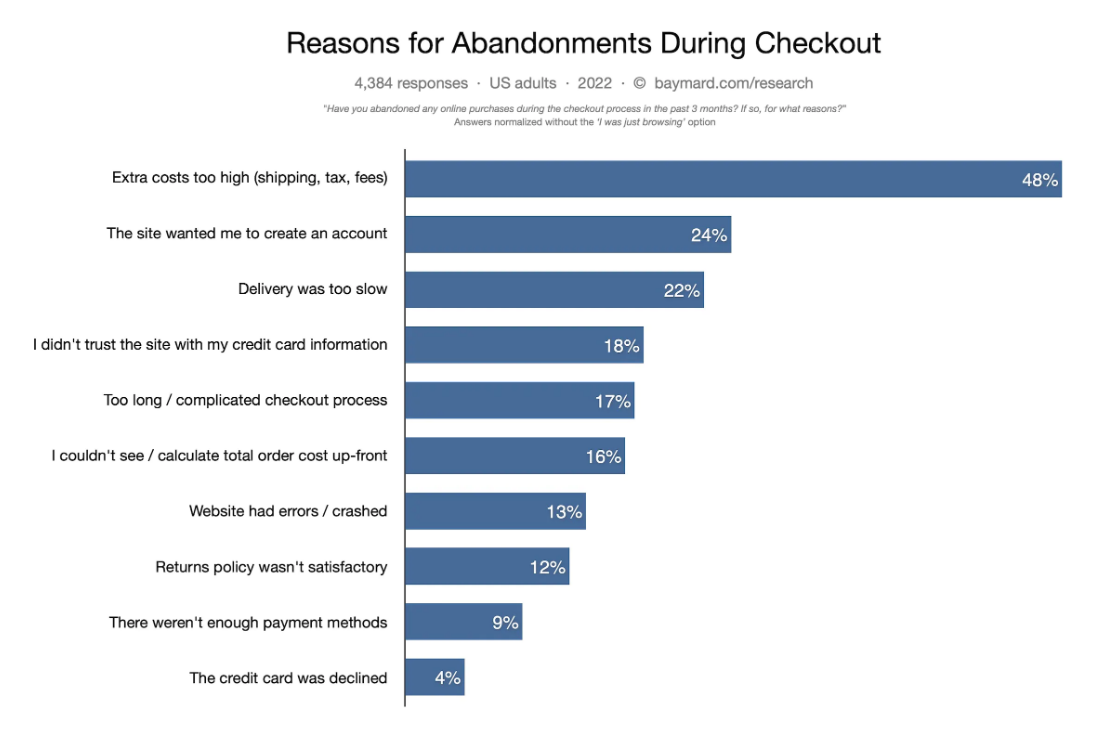

An integral part of this convenience is the ease and security of payments. No one will use online shopping if the checkout process is not smooth and secure. Research has found that 18% of people abandon their carts because they don’t trust the site with their card information, and 17% do it because of the lengthy checkout process.

So, the key to reducing this abandonment rate lies in making customers feel safe and streamlining the checkout process to make it shorter and smoother. And this is where the mobile payment gateway comes in.

What is a mobile payment gateway?

A mobile payment gateway is a payment gateway that enables the transfer of money from a customer’s account to the merchant’s account securely and quickly. It verifies, authorizes, and processes payments while keeping the customer’s data secured through encryption and various security protocols.

The entire process takes no more than a few seconds. However, it is a complex process. Let’s discuss how it works.

- The customer selects the product/service they want to purchase and adds it to their cart.

- From the cart, they go to the payment section.

- They select the payment option they want to use. It could be a credit card, debit card, UPI, or digital wallet.

- After selection, they are redirected to the payment gateway to add their details. For example, customers who want to pay using credit cards add their card details.

After this, the process that happens in the backend is as follows.

- The gateway sends the information to the card company, which verifies the data.

- Subsequently, the data is shared with the issuing bank, which approves or rejects the payment based on the balance available in the customer’s account.

- On successful verification, the payment gateway receives the confirmation, and the order is placed.

The process may seem complicated, but all the customer sees is the order confirmation/failure. Therefore mobile payment gateways are highly popular.

Benefits of mobile payment gateway

While e-commerce is a thriving industry, there is no lack of competitors. You need excellent products/services and a stellar customer experience to survive and succeed in this industry. And that is precisely what a payment gateway for mobile apps enables. Let us look at some of the benefits of using a mobile payment gateway.

Also Read: 7 Best Payment Gateways for eCommerce Websites in UAE

More customers

In 2022, mobile e-commerce sales contributed 72.9% of total e-commerce sales. And that ought to tell you the first and most important benefit of a mobile payment gateway. With the increasing access to smartphones worldwide, this number will continue to rise. Another study found that 57.5% of people used mobile apps for shopping because of their convenience. Therefore, a secure and easy-to-use mobile payment gateway is integral to getting more customers and retaining them.

Secured payments

Research has shown that 8 in 10 customers are concerned about their data being exposed during online shopping. Data security is the topmost concern of most customers. The e-commerce industry lost $20 billion to scams in 2021 alone. Due to built-in misuse detection features, mobile payment gateways are useful for thwarting unscrupulous transactions. Payment gateways also comply with PCI DSS, which ensures that customer data remains safe and secure.

Also Read: Tips for Safe Online Transactions

Flexibility

Today’s customers want more and more flexibility and alternatives to choose from. From options in the product to choices in payment methods, the more options, the better it is for you. Payment gateways offer several payment methods, such as recurring billing, to offer greater flexibility to your customers. They also allow you to reach people worldwide.

Other benefits of using a payment gateway include the following.

- It provides customers with the ability to shop 24*7*365

- Saves time by facilitating the payment process quickly

- Improves customer satisfaction and offers superior customer experience

- Increases sales and revenue

- Reduces the risk of being deceived

Factors to consider while choosing a mobile payment gateway

There are many mobile payment gateways in the market. And many of them provide excellent services. However, the key is to find the one that suits your needs. That is why, before choosing a mobile payment gateway, understand your needs and goals and find the answer to these questions.

Also Read: QR Codes are the Future of Mobile Payment System – Find Out Why

Who is your audience?

Not all mobile payment gateways are available worldwide. Where do your customers live? Answer that question and choose a gateway available in all those countries.

Which payment methods are used by your customers?

Check what payment methods are most used by your customers and ensure what your payment gateway offers them. However, the best thing is to choose a payment gateway with as many payment methods as possible.

Also Read: UAE Set to Become a Cashless Society with Increasing Mobile Payments

Does the payment gateway have relevant security certificates?

As mentioned before, security is at the forefront of customers’ minds. Ensure that your payment gateway has all the necessary certifications.

What is the cost of the gateway?

Each mobile payment gateway has different pricing. Typically, there’s a setup cost, a monthly fee, and a transaction fee. Check whether it fits your budget. Always read the fine print carefully and ensure there are no hidden costs.

Can the payment gateway be easily integrated into your mobile app?

Customers need an uninterrupted and smooth experience to come back to your brand. Therefore, the payment gateway must be properly integrated into your app. A good payment gateway will have an easy integration process and will not require many resources.

Is the checkout process smooth and convenient?

Test the payment gateway yourself before integrating it into your app. Check whether the checkout process is convenient and seamless.

With mobile e-commerce contributing more and more to total e-commerce sales, it has become essential for merchants to provide a smooth checkout process on their mobile apps. The above factors can help you find a good mobile payment gateway for your app.

Matthew Cooper – Marketing Automation & Operations Manager, Global App Testing

Matthew Cooper – Marketing Automation & Operations Manager, Global App Testing

Emily Rollwitz – Content Marketing Executive, Global App Testing

Emily Rollwitz – Content Marketing Executive, Global App Testing