Why White-Labelled Payment Solutions Are the Future for Corporate Banking

The corporate banking landscape is evolving rapidly, with businesses demanding faster, smarter, and more secure payment solutions. Traditional payment infrastructures often fall short in meeting these expectations, leading to inefficiencies and lost opportunities.

Enter white-labelled payment solutions customizable, scalable, and AI-powered platforms that are changing how businesses handle transactions. Combined with payment orchestration, these solutions offer unparalleled flexibility, security, and efficiency.

In this blog, we explore why white-labelling is the future of corporate banking and how PayTabs Consultancy empowers businesses with cutting-edge payment expertise, AI-powered payments, and technical expertise.

The Rise of White-Labelled Payment Solutions

White-labelling allows businesses to rebrand and deploy payment solutions under their own name, eliminating dependency on third-party providers. This approach is gaining traction across multiple industries, from fintech and eCommerce to healthcare and travel, due to its:

✅ Brand Consistency – Maintain a seamless customer experience under your own brand.

✅ Scalability – Adapt to growing transaction volumes effortlessly.

✅ Cost Efficiency – Reduce development costs with ready-made, customizable solutions.

✅ Enhanced Security – Leverage enterprise-grade payment infrastructure with fraud prevention.

AI & Payment Orchestration: The Game Changers

Artificial Intelligence (AI) is transforming payment processing by enabling:

🔹 Fraud Detection & Prevention – AI algorithms analyze transaction patterns in real-time to block suspicious activities.

🔹 Smart Routing – Optimize payment success rates by dynamically selecting the best acquirer.

🔹 Personalized Checkout Experiences – AI-driven insights help tailor payment methods to customer preferences.

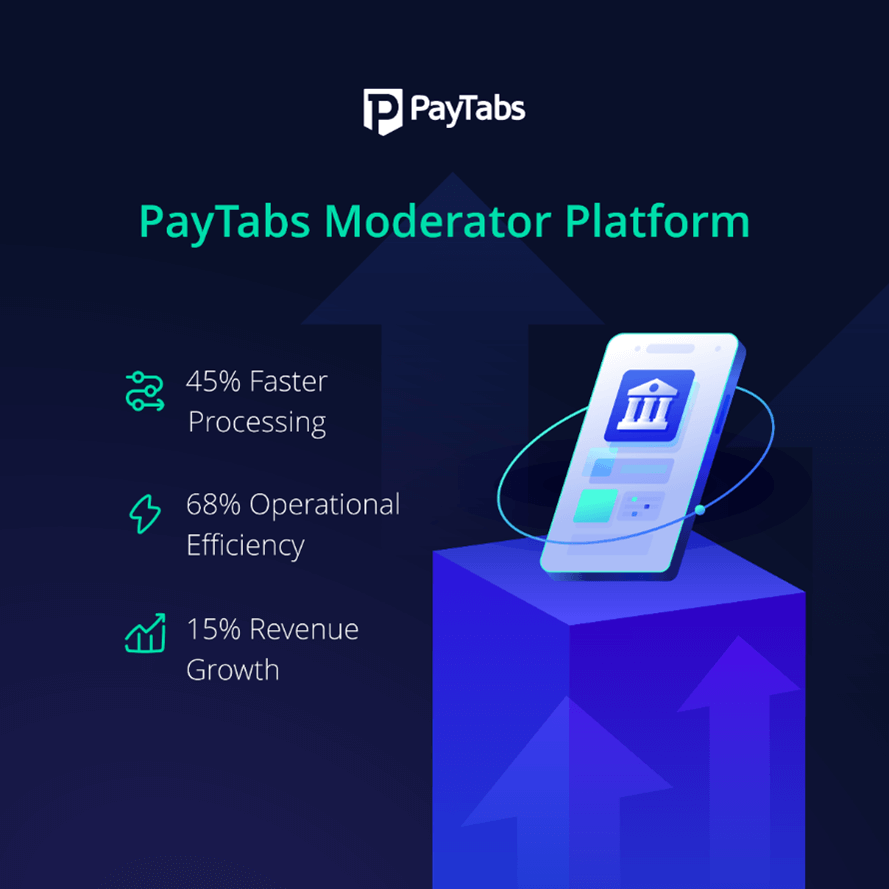

When combined with a payment orchestration platform, businesses gain a moderator platform that centralizes multiple payment methods, gateways, and processors into a single, streamlined system.

Why Choose PayTabs Consultancy?

As payment consultants and technology consultants, PayTabs offers:

✔ End-to-End White-Labelling: Custom payment solutions tailored to your brand.

✔ AI-Powered Payments: Smarter, faster, and more secure transactions.

✔ Global Payment Acceptance : Support for multiple currencies and payment methods.

✔ Seamless Integration: API-driven solutions for quick deployment.

Whether you need a white-labelled payment gateway or a full payment orchestration platform, PayTabs provides the technical expertise to future-proof your payment infrastructure.

The Future Is White-Labelled & AI-Driven

As corporate banking shifts toward digital transformation, businesses must adopt agile, scalable, and intelligent payment solutions. White-labelling, powered by AI and payment orchestration, is no longer optional, it’s essential for staying competitive.

Ready to elevate your payment strategy? Explore PayTabs’ solutions today:

🔗 White-Labelled Payment Solutions

🔗 Payment Orchestration Platform

By partnering with payment experts like PayTabs, your business can unlock seamless, secure, and scalable payment processing, paving the way for the future of corporate banking.

Final Thoughts

The convergence of white-labelling, AI, and payment orchestration is setting a new standard in corporate banking. Companies that embrace these innovations will lead the market with faster transactions, reduced costs, and superior customer experiences.

Stay ahead, choose PayTabs Consultancy for AI-powered payments, technical expertise, and a future-ready payment infrastructure.

Would you like to integrate a white-label solution for your business? Contact PayTabs today!