Build your dream business and get paid in seconds with Paymes

Marketing and cashflow issues threaten small businesses in MENA

Small businesses are the backbone of the majority of the Middle East and North Africa (MENA) economies. According to the International Monetary Fund (IMF), over 90% of the region’s businesses are small businesses. In 2021, over 77% projected revenues that were steady or growing.

Freelancing is booming in the region after the pandemic. A 2022 survey by Bayt.com found that 78% of respondents plan to do more freelance work and 87% believe there is a surge in demand.

While the growth of entrepreneurship and freelancing is a positive sign, it is not easy to succeed in MENA. The region is still learning about digital marketing and fintech. Many SMEs are still adapting to the internet age. Only 55% of SMEs in MENA have a website. A meagre 46% have a social media presence.

Two of the key challenges they face are setting up their own platform to attract clients and getting paid on time, without hassle. 82% of small businesses fail due to cash flow issues, so it is a challenge that can end your business.

“Payment was easy to set up and use right away, the dashboard is user friendly and to the point. Highly recommend it for freelancers.”

Mostafa Kandil, MK

Paymes Customer, Egypt

Paymes is here to help

Paymes, a new platform launched by PayTabs, will put these worries to rest. Paymes is now available in Egypt for its 18 million gig workers. More markets in Gulf Cooperation Council (GCC) will be able to access Paymes soon.

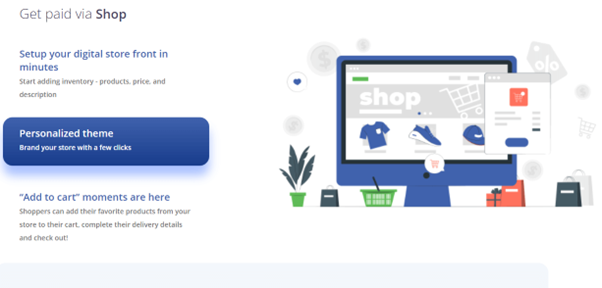

Paymes allows you to

- set up an online store for your products and services

- promote what you sell online

- get paid in seconds – no long paperwork for you or the buyer

- share secure payment links over 10 social platforms including Instagram, WhatsApp and Telegram

It is supported by Facebook Commerce and completely free to set up.

PayTabs has been a trailblazer in the region in fintech innovations. The company has developed many country-specific solutions, including mada (Saudi Arabia) and K-Net (Kuwait).

Paymes is a solution designed for small businesses and freelancers. It is made for craftsmen, coaches, designers, tailors, home cooks, gardeners, and anyone else who is freelancing or running a small business.

Whether you already have a business or simply have an idea in mind, you can use Paymes to create the vision you have in mind. There are no setup fees or monthly costs, just transparent transaction fees.

Paymes will allow you to receive instant payments from anyone anywhere in the world. Sharing a QR code or a link with the buyer is all that is necessary.

They only need to enter credit card details. You only need your IBAN details to collect the payment.

“ Paymes has a unique edge in the Egyptian market by offering a simple tool with very few steps for freelancers and social media businesses to enroll and build their marketplace.

Freelancers can now easily digitize their businesses in short 2-3 steps and display their products on Paymes for customers to buy and pay online.

We’re excited to launch Paymes and continue our efforts in enabling micro-businesses and adding value to them.”

Mohamed Serry

Country Manager – Egypt, PayTabs

Build your dreams with Paymes

Take charge and build the future you wish for. Let go of your marketing and cash flow worries. Start using Paymes today.

You only need digital copies of your Egyptian National ID card and a bank account statement. You can register with any Egyptian bank account, mobile wallet or Meeza prepaid card.

Create an account online or download the Paymes app on Apple App Store and Google Play.

– Kasun Pathirage is an expert freelance content writer for B2B fintech and SaaS brands.

Learn more about his work via his website: verbauream.com.

Find Out Why Having an Online Store Makes Sense

In 2022, shopping is no longer limited to physical brick-and-mortar stores. With advancement in modern technologies, availability of faster shipping options, and the recent pandemic that limited the movement of people, more and more customers are shopping online. While there are third-party channels like Amazon, Etsy, eBay and more that allow you to sell your products on their website, have you ever considered opening your own online store?

An online store dedicated to your brand and products can be tremendously beneficial as well as profitable. However, to reap the benefits of an online store, you must be familiar with how to create an online storefrom scratch. The process might sound too technical and troublesome but it’s quite simple and straightforward in fact. Read on to know more.

How to Open an Online Store?

Here’s a brief rundown of the process which you can follow to establish your very own store listed online and ready to serve customers. The best part about opening an online store is that you don’t need a lot of experience or technical knowledge and there is a plethora of tools available that are made specifically to help you with this journey. So, if you were wondering how to create an online store, follow these steps.

- Step 1: Decide on your niche and what you will be offering the customers. Is it clothing, food items, appliances or something else?

- Step 2: Choose whether you will house the products on your own or use a drop shipping supplier to take care of the shipping.

- Step 3: Come up with a customer-friendly business name and register a domain name online for the website.

- Step 4: Select and list the products that you will sell.

- Step 5: Create the website for your brand. You can do it yourself, take help from an online store builder or even hire a developer.

- Step 6: Get a sales tax ID since you’re now a business and would need to pay taxes on your products.

- Step 7: Run marketing campaigns to get the products in front of your audience.

Benefits of an Online Store

Interested to know about the advantages of an online store and why it scores higher than a physical one? After all, most big brands have official stores and retail outlets for people to walk in, roam around, feel the products, and then make a purchase. While there’s no alternative to physical contact with the products, an online store can provide several other benefits.

- Enhanced Communication with Customers: Online shopping allows brands to capture in-depth customer information like their purchase history, shortlisted products, email address, shopping preferences, and more. All this information enables you to connect with your customers better. Targeted campaigns, special discounts, and notifying the customers when their shortlisted product is back in stock can increase the chances of completing a sale successfully.

- Better Shopping Experience: This is one of the key benefits of an online store. Shopping online gives a certain amount of freedom to customers that can’t be found in physical stores. There’s no salesperson following them around the store to make them uncomfortable and no queues for them to stand in and wait. All they need to do is browse through the website, select products they like, and buy them instantly with the click of a button. No fuss. No hassle. And no carrying things around the store.

- Reduced Costs: One of the biggest reasons behind taking your business online is the reduction in costs. Sure, you will be paying server costs, website maintenance costs, infrastructure costs and such, but they will be far lower than paying rent for a commercial space, hiring employees, and maintaining the physical stock as well as the store. The amount spent on marketing online can be as minimal as you like.

- Increased Market Access: This is another one of the top advantages of an online store. Selling products over the internet opens a wide range of possibilities that just isn’t possible with independent stores. Not only can you market to people worldwide, but third-party drop shipping and fulfilment companies like Amazon and eBay make it possible for the products to reach even far-flung customers. Setting up a shop is easy and can happen in just a matter of minutes.

- Master of your Own Finances: Since you’re not partnering with third-party channels and selling products from your store, barring the cost of advertisement, shipping, and other overheads, all the revenue, as well as the profit, is yours to keep. While selling on Amazon or eBay might feel like a good side hustle at the beginning, the earnings will stagnate over time even if your business is growing. Getting away from any third-party agreement frees you from these shackles.

- You Have the Final Say: Another online store benefit? You are not restricted to the selling metrics and strategies of other third-party companies. You have complete authority over every business decision like how it’s going to operate, sales and marketing strategies to generate leads, product presentation, pricing, and even the way the order is packaged and delivered. Customer service also becomes more streamlined and efficient.

- Convenient payment system: In case of an online store, if you join hands with the right payment gateway solution provider, accepting and keeping track of payments will become a piece of cake. You will be able to offer your customers multiple payment modes too, including debit and credit cards, net banking, e-wallets and so on. No matter where a customer is located, the funds will be deposited in your account quickly. Sending invoices and reminders will also become easy, helping you to focus more on core business areas.

Wrapping Up

Building a business from scratch and running the same is not easy, be it online or offline. Each has its own difficulties and comes with its fair share of roadblocks, but you don’t create a multi-billion-dollar corporation piggybacking on another company. Plus, there are several benefits of an online store over an offline one, as you read above. And if yours is a growing business that aims to stay in the game for a long time, futureproofing the business is vital. The world is going global and physical borders are no longer a constraint for brands trying to reach their customers. So, now is the best time to go online.

A Basic Guide to 6 Different Payment Solutions For Freelancers

Freedom in what you do

Freelancing, sometimes known as independent contracting, offers workers a way to take charge of their work setup. What jobs you do, when you do them, and who you do them for, become matters that you can control in a way that a direct employee cannot. You may even choose where to work, perhaps hot-desking in a shared workspace or on the deck in the sun.

As a freelancer, you have the flexibility to earn around other life commitments and create a work/life balance that works for you. It’s a model of working that is suitable for many fields. Web designers can ply their trade to a variety of clientele. Freelancing opportunities abound for writers and editors. Graphic designers and artists can take advantage of the growing NFT art marketplace.

There are many important things to consider before pursuing the life of a freelancer. Work can be unsteady. It is up to you to find clients and generate business. Be wary of blurring the lines between work time and personal time. Chief among these concerns is how you get paid. Read on to see some tips for mitigating risks associated with freelancing, and for a basic guide to some of the payment methods available.

Tips for getting paid

- Create an invoice template you can easily edit for different clients.

- Use an easy meeting minutes template to keep track of what you’ve promised to clients and what they’ve promised to you.

- Before signing a contract with a prospective client, do some research to discover if there have been any reports of bad experiences from other freelancers.

- Ensure you have several points of contact with a client. If you’re freelancing for an organization, then make sure you can contact the HR department. You should have an established point of contact for invoicing.

- Try to glean some insight into the finance department structure of client organizations, so you know who to go to if there are any disputes.

How do I get paid?

There are many payment solutions for freelancers to choose from. You need to use those that work best for you and your clients. Below are 6 options for freelancers, along with some benefits and drawbacks for each method. Each payment solution will serve the purposes of some freelancers but not others. This basic guide will help you decide which payment platform best meets your needs.

Paypal

Founded in 1998, Paypal is one of the most well-established and best known methods for moving money around. According to Statista, Paypal had 426 million active users as of Q4 2021. As such a well-known payment platform it may seem like an obvious choice, however, there are pitfalls to be avoided.

Benefits

It is free to set up an account and all you need is an email address. Being such a well-known brand, clients can trust their online payment is secure; they offer robust buyer protection policies. Clients paying you through PayPal don’t actually need a PayPal account. If they are paying via credit/debit card, or with their PayPal balance, payments are sent in minutes.

Drawbacks

The protections PayPal offers are weighted heavily toward the buyer/client. In the event of a dispute, you could find funds are withheld or refunded. If you experience several disputes then you run the risk of your account being frozen. If you travel a lot, you may log in to your PayPal account from a “.co.uk” part of the world one week, a “.de” the next, then a “.ae” (you may be asking, what is .ae domain?) a few weeks later. All this travel can also run the risk of account suspension, although you can communicate with Paypal to outline your frequent travel.

PayPal has higher fees than some of the other options. The amount you pay in fees depends on what country you are operating from, what currencies are being used, and the amounts of money in question. They also charge a conversion rate if you are accepting payments in currencies other than your own. Payments made using electronic checks or bank transfers will be slower because they will need to be cleared by the financial institutions involved.

Bank Transfer

Money can, of course, be moved directly from bank account to bank account electronically. Western Union pioneered the wire transfer back in 1872. They used their telegraph network to communicate between offices which gave the process the moniker of telegraph transfer, by which it is still known in some countries today. These days, secure systems such as the SWIFT banking system ensure the secure transfers of funds.

Benefits

This method is available internationally, with few exceptions. Payments are processed nearly instantaneously when paid domestically, with international payments possibly enduring delays of a couple of days. It is extremely secure and so freelancers and clients can use it with confidence. Once you add your bank account details to your Paypal account, you can simply transfer funds.

Drawbacks

Depending on the banks involved, there can be expensive charges when transferring money internationally. Some banks charge flat fees for incoming and outgoing international payments. For small projects, then, this may be a method to avoid. Unless you have a good relationship with a client, they are unlikely to feel comfortable paying this way as there is little recourse in the event of a dispute.

Escrow

Escrow is a legal and financial agreement that is designed to give the confidence to transact with each other when they are unfamiliar. A third party will hold onto the payment until both freelancer and client are satisfied that work is complete and payment is due. Escrow.com provides this service for a fee.

Benefits

When totally unfamiliar with a client, Escrow can give you confidence that monies are secure in the event of a dispute. Freelancers and clients agree who pays the fees ahead of time and arrange an inspection period of between 1 and 30 days for the client to accept the goods or service provided. They are impartial arbiters, providing a fair way to do business across many countries.

Drawbacks

The fees are quite high. Anything below $300USD is a $10 fee. It’s, therefore, not a good option for small transactions. Although the inspection period can provide peace of mind, it also delays your payment by up to 30 days.

Venmo

Owned by PayPal, Venmo is a peer-to-peer payment platform. It is widely used throughout the US as a way to pay someone back for a takeout meal, for example. As an app-based platform, it is a convenient way to make and receive quick payments with no fees for bank transfers or Venmo account transfers, and only a 3% fee for credit or debit cards.

Benefits

Venmo is extremely fast and convenient. Thanks to its app-based structure, you can send notes along with payments and communicate within the app. When transferring money from Venmo to your bank account, you may have to wait one to three days. There is an option for a fast transfer for a charge of 1% up to a maximum of $10.

Drawbacks

Strictly speaking, Venmo doesn’t allow its platform to be used to pay for goods and services. If a client insists on paying this way then you risk having the payment reversed. It’s only available in the US right now and you can’t transfer money internationally. There are few protections for you as a freelancer or a client. It may be suitable for small dollar amounts but use with care and only with clients you have a good working relationship with.

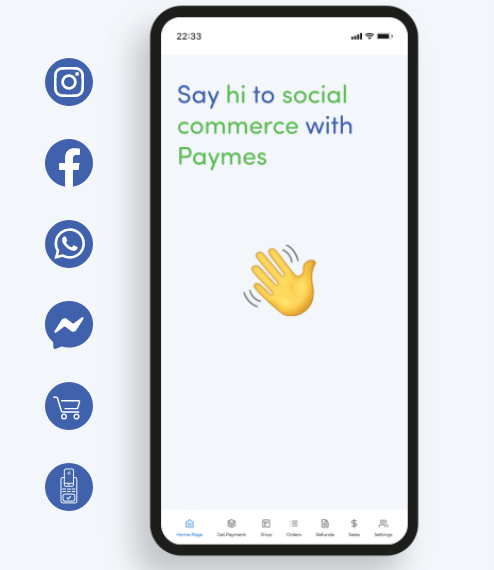

Paymes

Based in the Middle East/North Africa (MENA), PayTabs social commerce platform Paymes. Paymes is an app-based option aimed at freelancers. It promises a paperless, fast, and secure way to make and receive payments. It is brand new, with some details TBC. If they deliver what’s promised, it could be a viable option for many freelancers.

Benefits

You can create an online store with this platform, so it acts as an advertising tool as well as a payment platform. They are also payment partners with many social media platforms such as Facebook and Instagram. When a client wishes to pay for your service, you share a link or QR code with them. It is a convenient, and intuitive approach.

Drawbacks

There are still details to be worked out with Paymes. They won’t charge set up fees or an annual fee but there will be a transaction charge that is currently unknown. Any charge will likely be comparable to other platforms. Currently, Paymes is only available in the Turkey, Azerbaijan and Egypt.

Skrill

Skrill was once known as Moneybookers. It specializes in international payments using different currencies. With fees comparable to PayPal, it is an option to consider for freelancers regularly working with clients from other countries.

Benefits

Opening an account with Skrill is an easy process. Payments can be made worldwide and only an email address is required. It is safe and secure, being regulated by the UK’s Financial Conduct Authority. Payments can also be made in Bitcoin.

Drawbacks

Once you’ve opened an account with Skrill, there is an onerous verification process to endure. You will need to provide a photo ID along with a utility bill. Users complain of a slow process. They also complain about lackluster customer support, a chatbot for existing customers.

Payment power in your hands

Freelancers exert a lot of power over their ways of working. You’ll have to decide where you work, when you work, and for online-based working, choosing between single tenant vs. multi tenant cloud-based software.

When deciding on the choice of payment method, you will have your own unique things to consider. Use a meeting minutes generator to help you decide what the client will be comfortable with, in regards to settling bills. You are now equipped to find a payment method that best suits your needs.

Jenna Bunnell – Senior Manager, Content Marketing, Dialpad

Jenna Bunnell – Senior Manager, Content Marketing, DialpadJenna Bunnell is the Senior Manager for Content Marketing at Dialpad, an AI-incorporated cloud-hosted unified communications system that provides valuable call details for business owners and sales representatives. She is driven and passionate about communicating a brand’s design sensibility and visualizing how content can be presented in creative and comprehensive ways. Jenna has written for sites such as Promo and eHotelier. Check out her LinkedIn profile

7 Strategies That Are Proven to Reduce Involuntary Churn (And Help Win Your Customers Over)

Let’s say you’re an app developer. You’ve found your niche, built an original app that you just know people will love, optimized your marketing and discoverability plan, and have what you think is a fail-proof monetization strategy. But for some reason when it comes to product launch a high churn rate is killing your profit margin.

In the language of sales, customer churn rate is the percentage of customers that stopped using your company’s product or service during a certain period of time.

To calculate your churn rate, just divide the number of customers you lost during a certain stretch of time by the number of customers you had at the beginning of that time period. For example, if you started the quarter with 400 customers and ended it with 380, your churn rate would be 5% because you lost 5% of your customers.

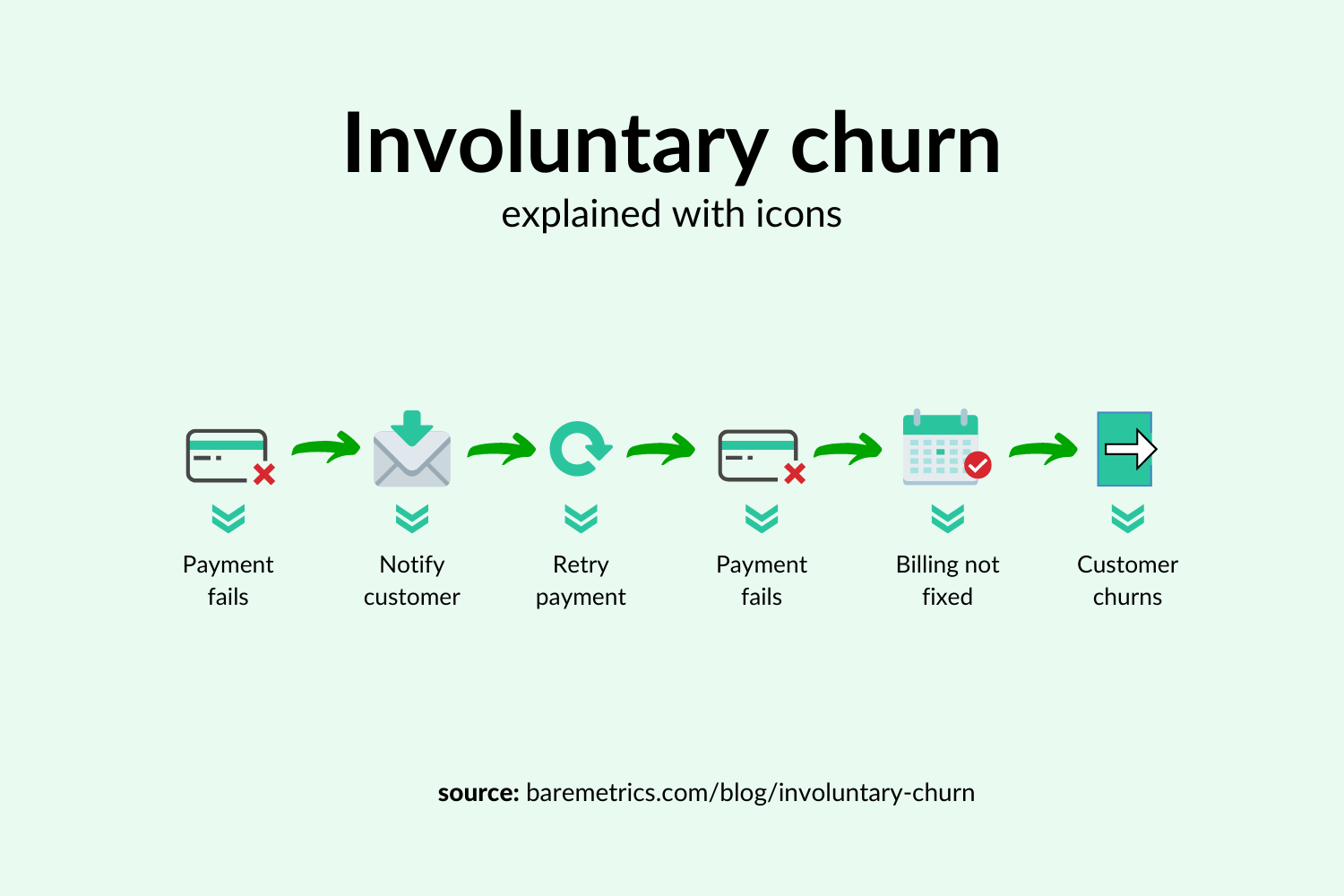

What is involuntary churn?

No matter what product or service you sell, attracting potential customers and convincing them to part with their money is all well and good, but if for whatever reason they can’t finalize payment, you’ve lost a sale.

Involuntary churn is exactly this. It refers to when a customer is ready to make a purchase but some unforeseen difficulty prevents them from doing so.

Because we tend to think of churn rates as a metric that applies to existing customers, we often talk about involuntary churn as a feature of subscription services or business models that rely on repeat payment.

When analyzing your website’s traffic, it is useful to think about bounce rate vs exit rate in order to get a clear picture of which stage of the user experience people are leaving the site. The same logic applies to churn rates. When exactly in the customer lifecycle you are losing business is just as important as why.

1- Analyze what’s causing your company’s involuntary churn

When thinking about involuntary churn, the first thing you need to ask yourself is what’s causing the churn.

Are payments defaulting because of a problem with your payment gateway? Or is it an issue with your web design that’s causing the site to crash at the point of sale?

Different businesses will find that different things are causing customers to churn involuntarily. There’s no straightforward way to figure out what’s causing involuntary churn and ultimately it will take different types of testing to do so.

2- Apply best practices when sending dunning messages

Dunning is the process of methodically communicating with customers to ensure the collection of payments owed. It’s a simple but effective way of addressing involuntary churn that many businesses apply to the management of their repeat customers.

If you’re signed up for any repeat payments, subscriptions, or buy-now-pay-later services, you may have received dunning messages in the past. They typically take the form of an email or SMS sent if an expected payment hasn’t been processed for any reason.

If your dunning messages are accusatory or confrontational, you risk alienating the customer for good. After all, most failed payments can easily be rectified by customers simply re-attempting the payment or updating the payment details.

Ensure your dunning messages clearly explain what has happened, how the customer needs to proceed, and what the next steps are if they fail to make payment.

3- Use card updaters

For merchants who accept credit or debit cards for recurring charges, expired card numbers can be a leading cause of failed payments and involuntary churn.

Card updater services offer an alternative to trying to get in touch with customers on your own. In recent years, American Express and Mastercard have both accelerated innovation in the field and it’s now easier than ever to automatically update card details.

Compared to trying to get in touch individually, automatic card updaters help you to retain customers while saving time for everyone involved.

American Express offers a service known as Cardrefresher which allows merchants to keep customers’ Amex card details up to date. The service offers daily updates. Merchants can receive the updates directly or through a vendor or processor that updates their recurring billing or card-on-file data.

The Mastercard Automatic Billing Updater is a similar service designed to assist merchants in keeping their on-file card information current. In the Mastercard system, issuers submit account changes to Mastercard’s database, which merchants can access and use to update their own records.

4- Offer multiple payment options

By multiplying the options for payment, and allowing customers to enter a backup option if one fails to process a payment, you increase the likelihood of successful payment and decrease your customer churn rate.

For truly global businesses, make sure you’re partnered with a payment gateway like PayTabs that supports multiple currencies. Nothing is likely to send customers elsewhere than not being able to pay in the currency of their choice.

5- Encourage direct debit for recurring payments

Direct Debit refers to when customers give their banks the authority to automatically pay recurring charges. It has been one of the most useful banking technologies for businesses that rely on these recurring payments. It is the preferred arrangement for paying utility bills such as gas and electricity and for subscription services such as SaaS business models.

In today’s international payment environment, the best way to get set up for direct debit payments is to enlist the help of a globally-minded payment gateway, that gives you access to the different technologies used to process direct debits around the world. For example, EG-ACH in Egypt or Masav in Israel.

Remember that direct debits can be used for both incoming and outgoing payments. As well as helping you to reduce involuntary churn by making repeat payments easy for your customers, it can be one of the best tools for affiliate marketing by helping you to pay your affiliates on time.

6- Optimize your retry cycle

Businesses that rely on some form of electronic payment usually implement a retry cycle that automatically attempts to process a payment again when it fails.

Retry cycles are especially important in fields such as mobile eCommerce in which retailers are entirely dependent upon virtual payment methods.

When thinking about your retry cycle, it helps to divide declined payments into what are known as hard declines and soft declines.

A hard decline is when the issuing bank does not approve the payment. Causes of hard declines include:

- Stolen Card

- Invalid Card

- Closed Account

With hard declines, you often need to ask the customer to retry, usually with a different payment method.

A soft decline happens when the issuing bank approves the payment, but the transaction fails at some other point in the process. Typical reasons for a soft decline are:

- Processor Declined.

- Card Activity Limit Exceeded.

- Expired Card.

- The Purchase is Unusual.

- The Billing Address and the IP Address Do Not Match.

- The Card is Being Used Abroad.

For soft card declines, it is best to retry the payment at least once straight away. For hard declines, the ideal retry cycle is to retry again over the coming days or weeks. This gives people a chance to rectify the issue, for example by adding new payment details or funding their bank account if the card has insufficient funds.

7- Don’t cancel unpaid subscriptions

Some businesses automatically cancel unpaid subscriptions without giving the customer a chance to pay another way.

When there’s so much technology out there to help you collect repeat payments, even if your first attempt fails, canceling subscriptions without following up with your customers just doesn’t make sense.

Before canceling any subscriptions, first, you should find out why the subscription is going unpaid. For example, outsourced or inhouse testing might uncover an issue with your payment setup that is causing failed transactions that your customers don’t even know about. If this is happening, canceling the unpaid subscription would create a loss of revenue that could be avoided.

Conclusion

Whether your business model relies entirely on repeat payments, or a combination of payment types, reducing involuntary churn is a simple but effective way to increase your profits.

After all, a happy customer who continues to pay month-in month-out for a service they value is a great thing for any business. These types of customers can help you survive dips in growth and keep the revenue coming in when other sources dry up.

Emily Rollwitz – Content Marketing Executive, Global App Testing

Emily Rollwitz – Content Marketing Executive, Global App Testing Emily Rollwitz is a Content Marketing Executive at Global App Testing, a remote and on-demand app testing company helping top app teams deliver high-quality software, anywhere in the world. She has 5 years of experience as a marketer, spearheading lead generation campaigns and events that propel top-notch brand performance. Handling marketing of various brands, Emily has also developed a great pulse in creating fresh and engaging content. She’s written for great websites like Airdroid and Shift4Shop. You can find her on LinkedIn.