GCC Financial Forum 2018

PayTaber and Chief Digital Officer Philippe Berard speaks on the panel ‘Payments at the heart of the system’ at the GCC Financial Forum 2018 at the Four Seasons Hotel, Manama, Bahrain.

Industry Solutions

Payment Solutions

Developers App

About

Resources

Join Our Family

Become A Partner

Contact Us

Server Status

Help

PayTaber and Chief Digital Officer Philippe Berard speaks on the panel ‘Payments at the heart of the system’ at the GCC Financial Forum 2018 at the Four Seasons Hotel, Manama, Bahrain.

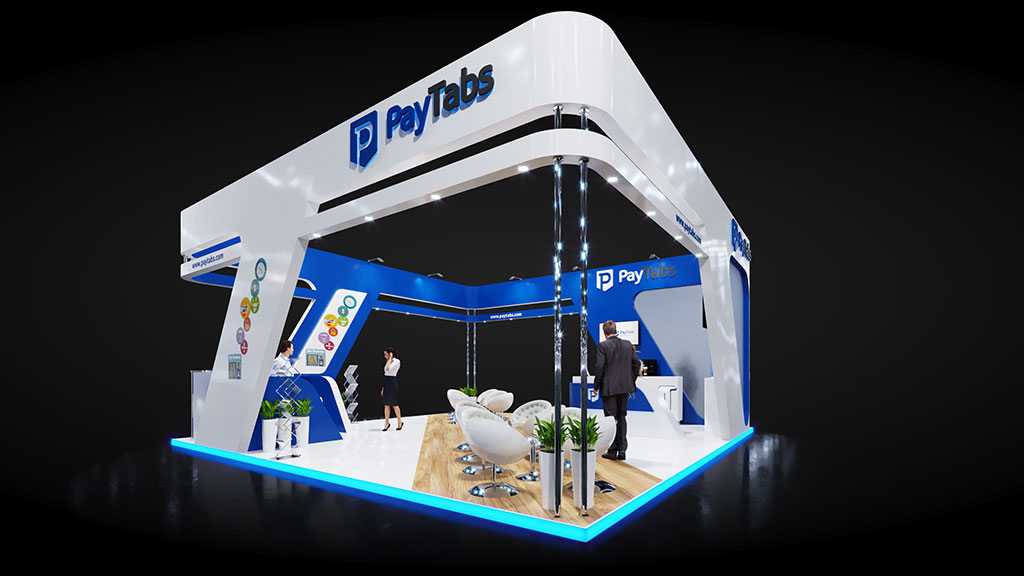

Establishing partnerships and collaborations are a core pillar of the payments world. Pictured here are PayTabers meeting and greeting clients and showcasing product innovations at past Seamless Middle East events.

Just like a brick and mortar store, the success of an online business depends largely on the loyalty of its client base. In order to build and retain a loyal customer base, it is essential to streamline your business practices. And one smart way to do that is by providing an efficient and simple online payment process. By simplifying your online payment process, you can instantly lower the risk of incomplete transactions and abandoned shopping carts. So, check out these 5 tips to make your online payment system smooth and efficient.

The foremost feature of an online payment system is its flexibility. Internet based businesses should try to offer as many different online payment options as possible. The idea is to ensure that none of your prospective client leaves the site on account of not being able to pay. Debit cards, credit cards and online banking are generally the most widely used options for making online payments. However, you can go beyond that and offer more choices such as payment through online wallets. Further, even within the debit and credit card ecosystem, you can offer choice of different cards. However, after a certain limit, expanding your payment pipeline may not be cost-efficient. Therefore, it is important to fully analyze your target market to pick the best payment options.

The online payment modes should be seamlessly integrated with your website. The setting up of an online payment system also requires collaboration with a number of external partners. Hence, several factors will be at play. While it is not possible to have complete control over these factors, it is important that their features are adequately modulated to provide a smooth experience to your clients. Such consistency is also useful in raising brand awareness and brand loyalty. Integration is also important to minimize the risk of online frauds and scams.

Apart from making the online payment process smooth and fast, it is important to ensure the safety of data as well. Online payment systems are highly susceptible to scams and phishing. Since these transactions involve sensitive data, it is vital that the customers are assured that their information will remain safe. For this purpose, you can obtain a Secure Sockets Layer or SSL certificate for your website. Display of this certificate on your website will provide a sense of security to your clients. A PCI-compliant website is also an assuring signal.Further, you should keep your software updated to ward off any phishing attack. Use the latest versions of antivirus and anti-scam software.

Even a simple payment gateway may become more efficient with just a few tweaks. When you design your online payment system, you should try to keep it simple. A simple design ensures that you can make changes to it without any hassle. Your online payment system can also allow feedback from clients. Such feedback can provide interesting insights and may help you in designing an even better system. A simple payment system will also allow timely rectification of any shortcomings or errors.

Online payment systems usually follow complex processes. While you can design your own payment system, it is generally more efficient to outsource the entire ecosystem or some important parts of it. You can collaborate with online payment processing services providers for this. These providers offer a wide range of services, such as the ability to process different payment methods and dealings in multiple currencies. These providers also use sophisticated tools to ensure speedy payment processing, making your business more liquid and efficient. By collaborating with reliable and reputed online payment services providers, you can provide the best payment system to your customers.

So, keep the above guidelines in mind, to provide your clients with a super efficient online payment process, which is not only fast and smooth, but also reliable and safe. These features can help you enhance your revenue in a significant manner.

Also Read: How PayTabs is making it super easy to manage your online store’s payment process

Information technology has made the world a smaller place indeed. Businesses are now able to expand their horizons beyond national boundaries easily. However, there are still certain roadblocks which may prevent your business from realizing its true cross-border potential. Going global not only allows you to offer your products and services to a larger clientele but also lets you achieve economies of scale. In order to ensure that you undertake this endeavor in the right manner, here are some top tips to help you expand your business globally.

As you prepare your business to transact internationally, you should ensure that you are able to transact in foreign currencies. Apart from fulfilling legal requirements, it is also advisable in terms of logistics. You can take the help of dedicated online payment processors, which may get your global financial platform up and ready in a matter of minutes. Reputed online payment processors may provide you with a host of other services as well, such as centralized dashboard for managing your transactions and analytical services. There are several factors you should keep in mind while choosing a payment processing service provider. Apart from having solid reputation in the market, the service provider should also be able to provide cutting-edge technological support and have the ability to accept a wide range of payment methods.

Every business is governed by a set of rules, the law of the land. When you are a domestic company, you only need to comply with the laws and regulations of that country. However, when you expand internationally, you need to ensure that your business does not breach the laws of any country you have customers in. Such rules and regulations may pertain to the form of business, the quality of the goods and services provided and foreign exchange remittances. Various online payment processors have made it easy for businesses to transact in foreign currencies, however, businesses still need to follow the laws and guidelines with regard to foreign currencies. Further, many countries prohibit trade in certain goods and services, and so, make sure you are not flouting any such rule.

Different countries not only have different legal environments, but distinct cultural climes as well. Such differences mean that you may have to redesign your marketing message to suit the tastes and traditions of your target markets. You should know your target markets well enough to understand their undertones and nuances. Moreover, you may also need to customize your product descriptions and packaging so that your target market can understand the message correctly and conveniently. You should be extra cautious about ensuring that your products and services are culturally sensitive and do not offend the sensibilities of the local people.

The two main challenges related to international sales are the modes and costs of shipping. You can choose land, sea or air shipping of your products, in accordance with your clients’ requirements. While air shipping may be faster and safer, it is also significantly more expensive than other modes. Consequently, you need to reconcile the speed and costs of shipping products. You may also adopt flexible approaches where you ship products based upon the choice made by your clients. You should also ensure that your shipping method and other logistics meet the legal requirements and other stipulations.

When you start selling your products internationally, you need to calculate your prices for each market separately. This is important to ensure that you adequately cover all your costs. You may also need to adjust your shipping charges accordingly. However, for the ease of the business, it is recommended to average out the costs and employ global pricing for your products. This will help in making your business processes simpler and efficient. However, you may offer different options regarding the mode of shipping etc. to your clients and calculate the final price accordingly.

Global selling may seem like an onerous task in the beginning. However, by following a few guidelines, you can ensure that you make judicious use of your resources. The above tips will help you in covering all the bases and running your business smoothly.

Packaging is an often neglected but still one of most important parts of a business operation. The importance of packaging is even more crucial in the case of E-commerce as products spend a long time in transit, going through difficult situations. Packaging also has ecological side to it as wasteful packaging is said to have immense negative impact on the environment. Further, it is also important to control the costs associated with packaging. Here are some of the ways E-commerce businesses can enhance the value added by the packaging.

Packaging is much more than just wrapping the goods and sending them to customers. You can create your own brand identity through packaging. You can opt for custom packaging where you can create packages in different shapes and sizes and personalize them to reflect the core values of your business. Further, packaging may also be customized according to the customer base of your business. Either way, you can ensure that your packaging strategy does a lot more than just protecting and transporting goods. While the main purpose of packaging is to safeguard the goods, it may very well be used for branding purpose. Due to these reasons, packaging is an important concept which requires thoughtful consideration on the part of businesses.

There are several types of costs associated with packaging. Some of the direct costs are in the form of money spent on buying boxes, wrapping papers and wages paid to packing workers while indirect costs are incurred in the form of spoilage and wastage. It is important that both these costs are optimized so that the bottom line of the business is enhanced. With proper packaging, you can ensure that the product reaches their destination in the best possible condition, thereby reducing the chances of return. This can help you minimize associated postage costs and loss of reputation. You should also try to incorporate innovative techniques such as the use of eco friendly packaging material. Further, the costs may also be optimized by reducing the packaging material used, without compromising the safety of the goods and customers.

Packaging may be used for creating a better bond with your clients. The packaging of a product is the first instance of a customer’s interaction with your brand. Since first impression counts, it is important that you create a positive brand image in the eyes of your clients. The packaging should be secure but still should be easy to remove, without causing any undue hassle to the customers. Also your clients should be able to unpack the goods without leading to any damage to the goods. If a product is well packaged and is convenient to handle, then your customers will likely have better opinion of your business.

The value of packaging goes beyond protecting the goods. You can create brand value by paying attention to the way you package your product. You can create further value by customizing the packaging to meet the requirements of particular products. For example, if you deal with edibles and food products, you may have to opt for temperature controlled packaging so as to ensure the safe and secure arrival of your products. You can emblazon your brand name on the packaging to make a lasting impression on your customers. Another good practice is to add essential information pertaining to the product on the packaging itself.

While it is important to create brand loyalty and brand image through the use of packaging, it is equally important to ensure that various costs associated with packaging are optimized. Apart from financial costs, the social cost of packaging also needs to be considered. It should be ensured that the packaging is able to keep the goods safe but should not be excessive at the same time. It is also important to put emphasis on recycling of packaging material. There is also increased focus on using eco friendly packaging material.

Packaging is generally overlooked as an important part of a marketing plan. This concept has strong potential to help a business achieve its revenue and profitability targets while delivering value to its customers.

Also Read: What are the key components of a custom payment gateway