5 benefits of payment portals for small business credit collections

One of the biggest changes businesses have gone through in recent years is digitization. In addition to setting up an online presence for businesses, accepting payments online has also become normal. Payment portals have become an important asset for businesses worldwide and have benefitted them in numerous ways. The Covid pandemic accelerated this momentum, with more and more customers preferring the more convenient way of transacting online rather than paying cash and risking contact.

Payment gateways are a boon, especially for smaller businesses that might not even have a physical presence and are solely operating digitally. Online shopping has increased significantly in recent years, and not having a payment gateway can mean a substantial loss of business. In 2021 alone, the total market size of global payment gateways was valued at around USD 23 billion and is expected to grow at a CAGR of 22.1% by 2030. Are you still wondering if it’s worth investing in a payment gateway? Here are some more reasons that will make a case for payment portals, no matter if you’re a small business or an established brand.

Image link: https://cdn.pixabay.com/photo/2017/03/13/17/26/ecommerce-2140603_960_720.jpg

Benefits of Using Payment Portals for Business

Enhanced User Experience

Payment portals help in improving the payment experience for users. It makes it easier for the customer to pay for your products or services through the payment portal and provides full visibility of their transactional data. Customers have full transparency on their past payments, get instant notifications about successful payments, and have options for completing payments from different channels. Users spend a substantial amount of time searching and deciding on products and will not have a positive experience if it takes forever to complete the payment, even after deciding what to buy. Payment portals also take care of customer service in case any payment falls through or gets stuck in processing for a long time.

Safer and Faster Transactions

One of the most significant advantages of having a payment gateway is the peace of mind it provides to both customers and businesses. Robust payment gateways ensure that every transaction is secured and free from any phishing attempt. They have fraud detection tools in place, high-level data encryption methods, and comply with PCI-DSS standards so that you and your customers get maximum security.

Payment portals process payments quickly as well. The process of adding something to the cart, deciding how to pay, and completing the payment can be done in a matter of seconds and with just a few clicks. Not only does it enable businesses to accept payments quickly, it also allows them to regulate their cash flow seamlessly.

Low Set Up Costs

There is a common misconception among business owners that setting up a payment gateway requires a lot of effort and money upfront and is only suitable for large businesses and enterprises. However, this is not true. While payment gateways require some initial set-up costs and can also incur a small number of chargeback fees and transaction charges from the business, they are worth it in the long run. Payment gateways have become an important and integral part of how organizations conduct business transactions, with more customers preferring to pay for things online rather than using cash. This trend will also remain for the future, so having a payment gateway adequately set up in place will become a necessity for businesses. Hence, it doesn’t matter if you’re running a start-up or a small business. Paying a minimum cost for setting up a payment gateway will help your business grow and reach new heights.

Increased Sales

You might wonder how a payment gateway can help increase the sales of a business. After all, they just accept payments and don’t serve any marketing purposes. Payment gateways help in increasing sales by providing numerous ways of payment to the customer. They can pay for something via debit cards, credit cards, UPI, or any other mode of payment they prefer. This not only makes life easier for customers but this ease of transaction kind of allures them to come back and do more business. Further, it has been found that businesses that accept card payments tend to get a lot of impulse buys from customers. A swipe of the card completes the entire transaction, allowing customers to spend more without overthinking.

Also Read: 4 Ways to Prevent Credit Card Fraud at Your Business

One more way payment gateways help increase sales is by enabling the business to go global. Anyone with an internet connection can access your website and, with a robust payment gateway in place, can pay for products from any corner of the world. You can accept payments in multiple currencies and through several methods to cater to international customers as well without any hassle.

Business Growth

In 2023, the internet will become the best place to set up and grow your business. Digital businesses are easy to set up and free of physical constraints like having a brick-and-mortar store or a cashier to complete payment. With the help of payment gateways, anyone from a big business to an individual artist can reach people worldwide and accept their payments for a product or service. Merchants who accept online payments are trusted by customers more because they have to pass through rigorous compliance checks and various security measures. This instils confidence in users and attracts them to shop from your store more frequently.

Conclusion

Having an online payment gateway in place has transcended from being a good-to-have service to an absolute necessity. Customers look for online modes of payment no matter where they shop, and they are bound to do so because of the different offers and discounts they can score while paying online. A survey done by BI Intelligence found that nearly 25% of customers would leave your website, even after adding things to their cart, if they don’t find their preferred mode of payment available. That’s one out of every four potential customers. If you’re a small business or just starting your enterprise, PayTabs can help you set up a robust payment gateway for your store. It will ensure that the transactions are quick and secure and give you full visibility of the transactions on the platform.

Give Wings to Your Travel Business with the Right Payment Gateway

Ever since the pandemic eased out, more and more people have booked tickets to travel abroad, and most of these tickets were booked online. While tourism in the Middle East fell by 73% at the height of Covid-19, it recovered quickly and is expected to see a rise of more than 100% in 2022. Modern infrastructure blended with natural beauty, mesmerizing beaches, historial significance and tons of entertainment options is what attracts tourists the most. With middle eastern countries hosting numerous sporting events like the ICC World T20 tournament and the Fifa World Cup 2022, the number of people booking tickets online will increase exponentially. In fact, nearly 3 million people are expected to arrive in Qatar for the Fifa World Cup alone.

If you’re a travel agency trying to get back on your feet after the pandemic or are just starting out to attract customers, you should know the importance of payment gateways and accepting payments online from customers. Not only does it make life easier for customers, but it also ensures that transactions are completely safe and secure. While payment gateways are important for your travel business, choosing the correct one is also crucial.

In this article, we’ll list some points you can consider when selecting a payment gateway for your travel agency. It is important to understand that several vendors exist, and not every payment portal might suit your business needs and aspirations.

Tips for Choosing the Best Payment Gateway for Your Travel Business

Customer Service

One of the most important and basic features your payment gateway needs to have is efficient customer service. Travel agencies deal with customers from around the world, and they can face many different issues regarding payments, refunds, and more. Coherent customer service becomes necessary so that customers’ issues can be resolved promptly and effectively. Choose a payment gateway that is not only trustworthy but is available round the clock for your customers. They should also provide additional features like an active phone number that customers can contact for quick resolution and a working email address. There should also be support for handling queries online through the help of a chatbot or a voice bot.

Security

Your preferred payment gateway should be secure as well. Customers are always sceptical when transacting online and generally fear losing their money. Partnering up with a payment gateway that ensures safe and secure payments instils a sense of trust among the customers and gives them the confidence to not only do business with you but also come back in the future to do business with you again.

Look for payment gateways that offer bank-grade security features like PCI-DSS compliance, fraud detection, two-step verification, and more. Such features ensure that all your transactions are encrypted, safe, and protected from phishing or fraudulent activities. The fewer payment-related troubles you’ll experience, the more will be the faith of customers in your business.

Ease of Payments

Many of your potential customers leave the website if they don’t find their preferred mode of payment. You can lose a lot of business if your chosen payment gateway doesn’t allow customers to pay for products however they like. The best payment gateway for your travel business will accept payments in a number of different modes, currencies, and options. Along with providing different modes of payment, you need to ensure that paying for products on your platform is straightforward for even the least technically savvy person. Unnecessary complications and too many intermediary steps before a transaction are complete can trigger the customer to leave the payment mid-way and search for a competitor.

Cost

The next most significant factor you need to consider while choosing a payment gateway for your travel business is how much it will cost you upfront and in the long run. It’s important to understand that payment portals will incur costs in different areas, including the set-up fee, charge for every transaction, and an annual maintenance charge. If you’re a small travel agency or are just setting up your business, it becomes all the more important to analyse your budget and how much you can afford to spend on a new-age payment gateway.

Examine the volume of transactions your business experiences on a daily basis and estimate future trends. If your transaction volume is considerably high, choosing a payment gateway with a higher transaction fee and annual charge might not fit your budget. Similarly, if the transaction volume is low, you can look at some competitive pricing and still be profitable. However, it is vital to have a payment gateway in place in 2023, no matter what it costs, due to its high ROI in the long run.

Timely Payouts

Maintaining cash flow in your business is essential to ensure you don’t run out of funds when needed. Customers can book tickets and pay for services on the same day, but if it takes a lot of time to reach your bank account, then you have some deliberation to do about your payment gateway. While a three-day wait is considered typical for business payouts, anything more than that should be a reason for concern. If your payment partner takes more than three days or even a week to pay you back, it can cause serious cash flow issues, especially when customers ask for refunds or cancel their booking. Choose a payment partner that doesn’t have a history of delayed settlements and goes through with their payments at regular intervals.

Conclusion

An increase in the number of people opting for booking tickets online should be an indication of how important a payment gateway can be for your travel business. Apart from just booking tickets, it will prevent any fraudulent activities from happening with you or your consumer, provide complete visibility on the transactions, and help you increase your business. PayTabs is an excellent payment partner for your travel business. With decades of combined experience among the team and several clients under their belt, PayTabs is one of the best payment gateways for any business.

How are mobile payment gateways transforming the online shopping experience?

Mobiles are an inseparable part of our lives. Most of us prefer to do everything on our phones, including shopping. It comes as no surprise that 73% of people used their mobiles to make online purchases in 2021. And the number is only going to continue rising because of the convenience customers get from shopping using their phones.

An integral part of this convenience is the ease and security of payments. No one will use online shopping if the checkout process is not smooth and secure. Research has found that 18% of people abandon their carts because they don’t trust the site with their card information, and 17% do it because of the lengthy checkout process.

So, the key to reducing this abandonment rate lies in making customers feel safe and streamlining the checkout process to make it shorter and smoother. And this is where the mobile payment gateway comes in.

What is a mobile payment gateway?

A mobile payment gateway is a payment gateway that enables the transfer of money from a customer’s account to the merchant’s account securely and quickly. It verifies, authorizes, and processes payments while keeping the customer’s data secured through encryption and various security protocols.

The entire process takes no more than a few seconds. However, it is a complex process. Let’s discuss how it works.

- The customer selects the product/service they want to purchase and adds it to their cart.

- From the cart, they go to the payment section.

- They select the payment option they want to use. It could be a credit card, debit card, UPI, or digital wallet.

- After selection, they are redirected to the payment gateway to add their details. For example, customers who want to pay using credit cards add their card details.

After this, the process that happens in the backend is as follows.

- The gateway sends the information to the card company, which verifies the data.

- Subsequently, the data is shared with the issuing bank, which approves or rejects the payment based on the balance available in the customer’s account.

- On successful verification, the payment gateway receives the confirmation, and the order is placed.

The process may seem complicated, but all the customer sees is the order confirmation/failure. Therefore mobile payment gateways are highly popular.

Benefits of mobile payment gateway

While e-commerce is a thriving industry, there is no lack of competitors. You need excellent products/services and a stellar customer experience to survive and succeed in this industry. And that is precisely what a payment gateway for mobile apps enables. Let us look at some of the benefits of using a mobile payment gateway.

Also Read: 7 Best Payment Gateways for eCommerce Websites in UAE

More customers

In 2022, mobile e-commerce sales contributed 72.9% of total e-commerce sales. And that ought to tell you the first and most important benefit of a mobile payment gateway. With the increasing access to smartphones worldwide, this number will continue to rise. Another study found that 57.5% of people used mobile apps for shopping because of their convenience. Therefore, a secure and easy-to-use mobile payment gateway is integral to getting more customers and retaining them.

Secured payments

Research has shown that 8 in 10 customers are concerned about their data being exposed during online shopping. Data security is the topmost concern of most customers. The e-commerce industry lost $20 billion to scams in 2021 alone. Due to built-in misuse detection features, mobile payment gateways are useful for thwarting unscrupulous transactions. Payment gateways also comply with PCI DSS, which ensures that customer data remains safe and secure.

Also Read: Tips for Safe Online Transactions

Flexibility

Today’s customers want more and more flexibility and alternatives to choose from. From options in the product to choices in payment methods, the more options, the better it is for you. Payment gateways offer several payment methods, such as recurring billing, to offer greater flexibility to your customers. They also allow you to reach people worldwide.

Other benefits of using a payment gateway include the following.

- It provides customers with the ability to shop 24*7*365

- Saves time by facilitating the payment process quickly

- Improves customer satisfaction and offers superior customer experience

- Increases sales and revenue

- Reduces the risk of being deceived

Factors to consider while choosing a mobile payment gateway

There are many mobile payment gateways in the market. And many of them provide excellent services. However, the key is to find the one that suits your needs. That is why, before choosing a mobile payment gateway, understand your needs and goals and find the answer to these questions.

Also Read: QR Codes are the Future of Mobile Payment System – Find Out Why

Who is your audience?

Not all mobile payment gateways are available worldwide. Where do your customers live? Answer that question and choose a gateway available in all those countries.

Which payment methods are used by your customers?

Check what payment methods are most used by your customers and ensure what your payment gateway offers them. However, the best thing is to choose a payment gateway with as many payment methods as possible.

Also Read: UAE Set to Become a Cashless Society with Increasing Mobile Payments

Does the payment gateway have relevant security certificates?

As mentioned before, security is at the forefront of customers’ minds. Ensure that your payment gateway has all the necessary certifications.

What is the cost of the gateway?

Each mobile payment gateway has different pricing. Typically, there’s a setup cost, a monthly fee, and a transaction fee. Check whether it fits your budget. Always read the fine print carefully and ensure there are no hidden costs.

Can the payment gateway be easily integrated into your mobile app?

Customers need an uninterrupted and smooth experience to come back to your brand. Therefore, the payment gateway must be properly integrated into your app. A good payment gateway will have an easy integration process and will not require many resources.

Is the checkout process smooth and convenient?

Test the payment gateway yourself before integrating it into your app. Check whether the checkout process is convenient and seamless.

With mobile e-commerce contributing more and more to total e-commerce sales, it has become essential for merchants to provide a smooth checkout process on their mobile apps. The above factors can help you find a good mobile payment gateway for your app.

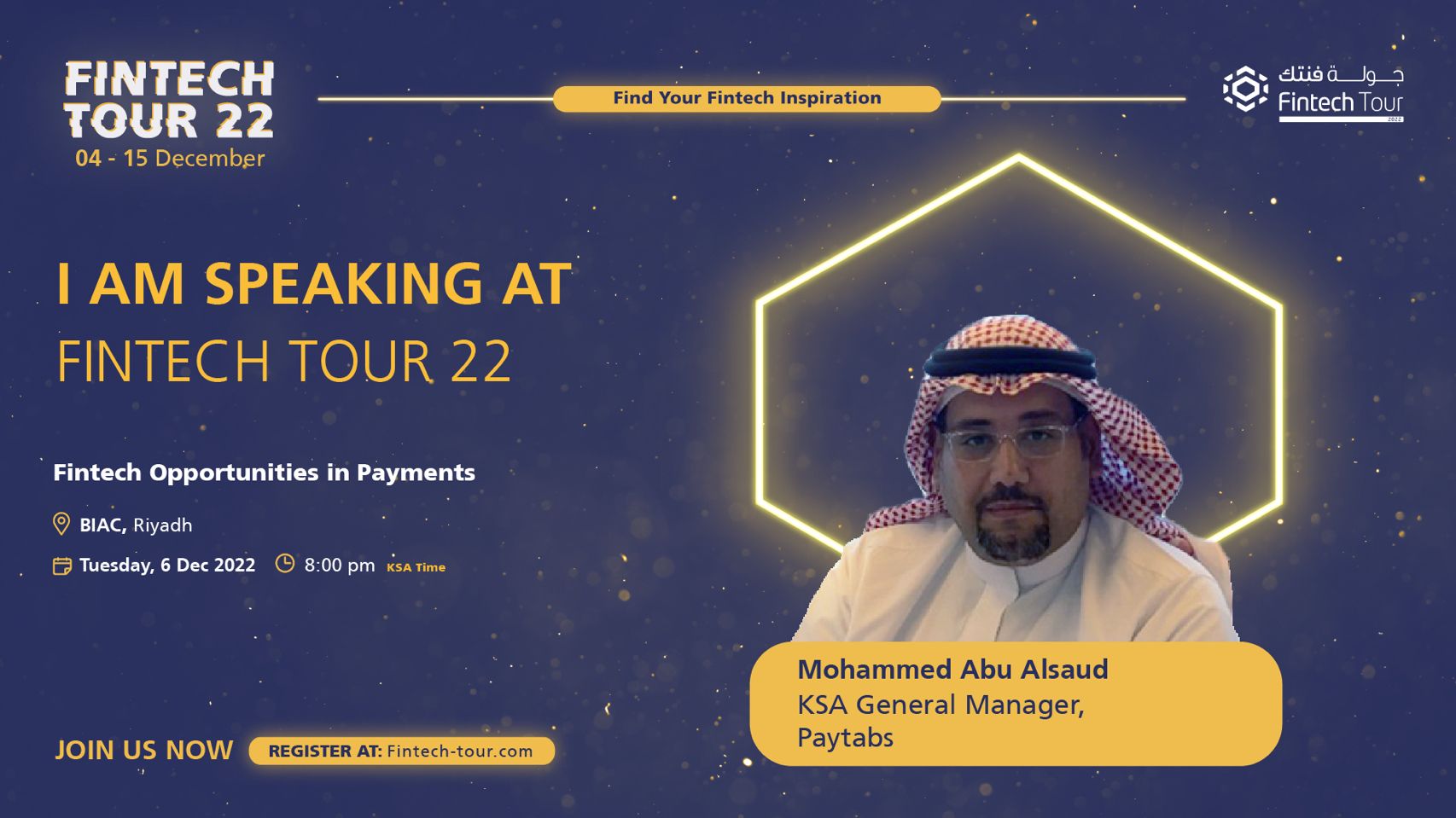

Fintech Tour 22 – Fintech Opportunities in Payments – Catch PayTabs Saudi GM Mohammed Abu Alsaud

Payments remains the biggest area of the fintech industry in Saudi Arabia making up 30% of all operating fintechs. However, despite this there are ample opportunities and challenges to solve. Hear from Saudi Payments, Tap Payments, PayTabs, Hala, and Nearpay on the opportunities in payments in Saudi Arabia and network with colleagues that are looking to improve payment activities in the Kingdom.

Watch PayTabs on the panel