The Best Social Commerce Platforms

Social media has revolutionized the way people communicate, share information, and engage with one another. Social commerce is an emerging trend that combines social media with e-commerce to create a seamless shopping experience. Social commerce platforms enable users to discover, research, and purchase products directly from social media channels. In this article, we will discuss the benefits of using social commerce platforms and the best social commerce platforms available.

What is Social Commerce?

Social commerce combines social media and e-commerce, allowing users to buy and sell products directly through social media channels. It is a way to connect with consumers on social media platforms, build brand awareness, and increase sales. Social commerce offers a unique opportunity for brands to interact with customers and create a personalized shopping experience.

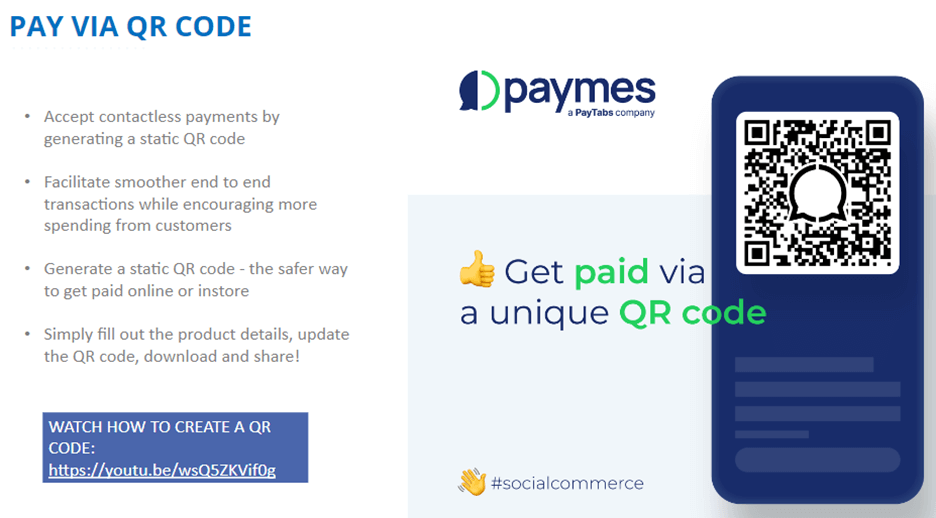

Also Read: Paymes Social Commerce Made Easy!

Advantages of Using Social Commerce Platforms

- Increased Visibility and Reach: Social commerce platforms allow businesses to reach a wider audience and increase their visibility. With over 76 billion active social media users worldwide, businesses can tap into a massive audience using social commerce platforms.

- Personalized Shopping Experience: Social commerce platforms allow businesses to provide a personalized shopping experience to customers. They can use customer data to suggest products that match the interests and preferences of loyal patrons and prospective customers.

- Seamless Purchasing Experience: Social commerce platforms provide a seamless purchasing experience for customers. They can browse products, read reviews, and make purchases without leaving the social media platform.

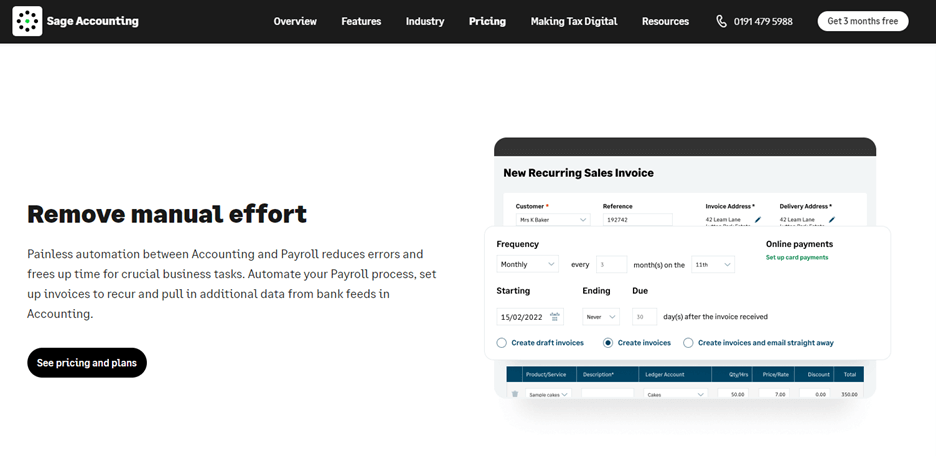

- Cost-Effective: Social commerce platforms are cost-effective compared to traditional e-commerce platforms. Businesses can save money on advertising costs and reach a larger audience without spending a lot of money.

Best Social Commerce Platforms

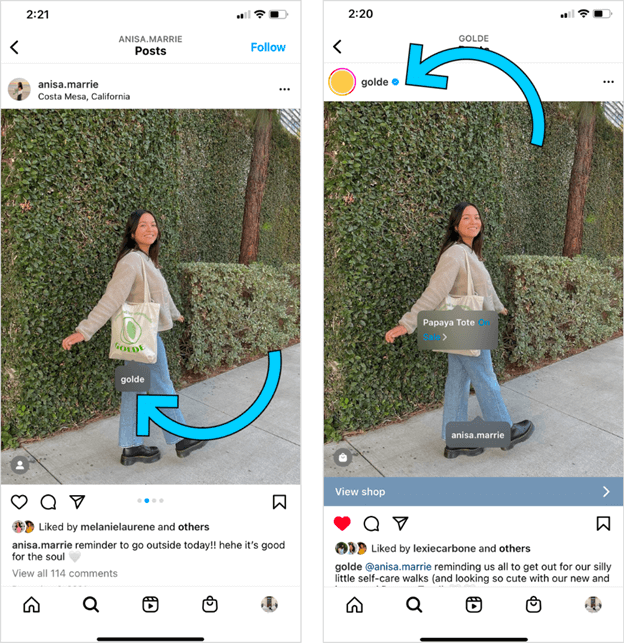

Instagram has more than 2.35 billion monthly active users and is among the most widely used social media platforms. It has evolved from a photo-sharing app to a social commerce platform, with features such as shoppable posts, Instagram checkout, and Instagram Shopping. Shoppable posts allow businesses to tag products in their posts, making it easy for customers to purchase products directly from the app. Instagram checkout offers a seamless buying experience, where customers can complete their purchases within the app. Instagram Shopping offers a dedicated page for businesses to showcase their products and drive sales. Instagram also offers features, such as Instagram Live and Instagram Stories, which businesses can use to engage with customers and promote their products.

With more than 2.963 billion monthly active users, Facebook is the largest social media platform on the internet. It offers several social commerce features, such as Facebook Marketplace, Facebook Shops, and Facebook Ads. Facebook Marketplace allows businesses to sell products directly to customers in their local area. Facebook Shops offers a dedicated page for businesses to showcase their products and sell them directly to customers. Facebook Ads allow businesses to promote their products to a targeted audience based on demographics and interests. Facebook also offers features like Facebook Live and Facebook Groups, which businesses can use to reach customers and showcase their products.

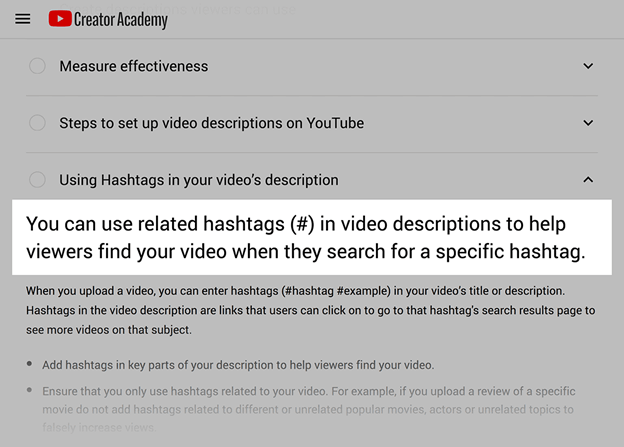

YouTube

YouTube has over 2.514 billion active users and is the biggest video-sharing platform. It offers several social commerce features, such as YouTube ads, YouTube Shopping, and YouTube Live. YouTube ads allow businesses to promote their products through video ads, which can be targeted to a specific audience. YouTube Shopping allows businesses to showcase their products in their videos and provide links to purchase them. YouTube Live allows businesses to engage with their customers through live video streams, which can be used to promote products and answer customer queries.

Pinterest is a visual discovery and bookmarking platform with over 450 million monthly active users. It offers several social commerce features, such as shoppable pins and Pinterest Ads. Shoppable pins allow businesses to tag products in their pins, making it easy for customers to purchase products directly from the app. Pinterest Ads allow businesses to promote their products to a targeted audience based on demography and interests. Pinterest also offers features, such as Pinterest Boards and Pinterest Lens, which businesses can use to showcase their products and engage with customers.

With more than 2.24 billion users worldwide, WhatsApp is one of the most popular messaging apps and offers several social commerce features, such as WhatsApp Business and WhatsApp Catalog. WhatsApp Business allows businesses to create a dedicated profile, manage customer queries, and promote products through the app. WhatsApp Catalog allows businesses to showcase their products in a dedicated catalog, making it easy for customers to browse and purchase products directly from the app. WhatsApp also offers features, such as WhatsApp Status and WhatsApp Groups, which businesses can use to promote their products to customers.

Conclusion

Social commerce has rapidly grown in popularity over the years, with more and more businesses turning to social media platforms to reach their target audience and drive sales. As social media continues to evolve, newer social commerce platforms are emerging every day, offering businesses even more opportunities to present their products and interact with their customers. From Instagram, Facebook, YouTube, and Pinterest to newer platforms like TikTok and Clubhouse, businesses have a wide range of social commerce sites to choose from to expand their reach, increase engagement, and drive sales. By leveraging the power of social commerce, businesses can stay competitive in the digital age and build a strong online presence.

Conrad

Conrad